Benchmark equity indices fell for the fifth consecutive session on Friday.

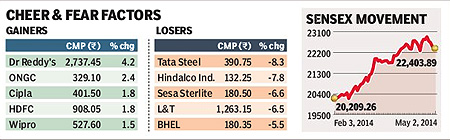

The Sensex fell 14 points (-0.06%) to settle at 22,403.89, after briefly rising to 22,570 levels. Nifty lost 1.60 points or 0.02% to end at 6,694.80. Benchmark indices lost about 1.3% in the week, leading to the biggest weekly fall in three months.

Selling by domestic institutional investors (DIIs) outweighed foreign institutional investors? (FII) buying. Domestic funds sold R405-crore shares in cash segment, showed provisional data from stock exchanges. Overseas funds net bought about $64 million (R386.95 crore) worth of shares, data showed.

DIIs sold R1,319 crore of shares in the week, while FIIs bought about $309 million of shares in the last four sessions, official data showed. No improvement in manufacturing data and the US Federal Reserve’s decision to trim its bond purchases by an additional $10 billion further spoiled investor sentiments. The HSBC India Manufacturing Purchasing Managers’ Index (PMI), a measure of factory production, remained steady at 51.3 in April.

Analysts said the volatility is going to spike as the day of poll outcome nears and markets may get more jittery as a result. Moreover, brokerages are recommending clients to book profits in stocks and sectors that have seen sharp upmove in the run-up to the election.

Andrew Holland, Ambit Investment Advisory CEO, said investors need to hold cash for now and deploy it after the election results. ?I am happy to sit on the fence with cash and wait to see how the event unfolds rather take a huge bet on what it is going to be,? Holland said, adding India’s economic and business environment has not changed at all, and the new government will have to take steps to improve the environment.

Analysts and economists also argued that the US Fed’s move to eliminate monthly asset purchasing programme will cause a collapse in asset prices and a severe recession.

Broader markets also witnessed selling pressure in the week. The BSE mid-cap index fell about 0.3% and the small-cap index lost nearly 1%.

Ten out of 13 sectoral indices ended in the red. BSE Capital Goods (-5.45) and BSE Metal index (-5.6%) featured among the top losers this week. The shares of Larsen & Toubro lost more than 5% during the week.

Losses in automobile company stocks mounted after data showed yet another month of poor automobile sales. BSE Auto declined 2.3% during the week lead by declines in Maruti Suzuki and M&M.

IT and healthcare stocks were the only gainers this week, as street again turned its focus on defensives. BSE Healthcare index rose 2.24% while CNX IT index advanced nearly 0.5% during the week.