Enhanced revenue visibility and sustained margin improvement call for higher valuation

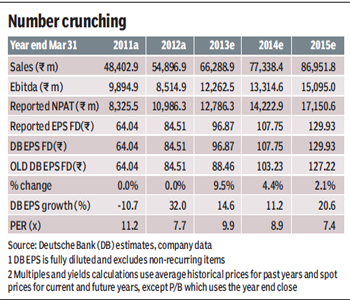

Increasing earnings estimates and target price: We raise FY13e (estimates) and FY14e earnings by 9.5% and 4.4%, respectively. Our revised target price is Rs 1,220 (vs. Rs 990). While FY13-15e earnings (excluding contribution from Satyam) CAGR of 13.5% is lower than our USD revenue CAGR (compound annual growth rate) of 19.1% over the same period; it is primarily due to our assumption of a stronger rupee (5.7% year-on-year appreciation in FY14e).

Enhanced revenue visibility (due to recent acquisitions and large deals) and sustained margin improvement are two key advantages of the company that leave room for an earnings beat. We reiterate our Buy rating on Tech Mahindra as our top pick in the midcap IT services sector.

Enhanced revenue visibility (due to recent acquisitions and large deals) and sustained margin improvement are two key advantages of the company that leave room for an earnings beat. We reiterate our Buy rating on Tech Mahindra as our top pick in the midcap IT services sector.

September quarter result beats expectations: Revenues at $299 million (+6.4% quarter-on-quarter, 1.1% above our estimate) were driven by organic growth of 1.7% q-o-q. The recent acquisition of Hutch Global Services contributed $13.3 million, or 4.7% q-o-q growth. Better operational efficiencies meant that operating profit Ebitda (earnings before interest, taxes, depreciation, and amortisation) at R3.4 billion (+2.3% q-o-q) was 7.4% ahead of Street and 5.8% ahead of our estimates. Ebitda margin at 20.7% (-69bps q-o-q) was affected by wage hikes, but was still 129bps higher than the Street and 111bps higher than our estimates.

Our earnings estimates are 11% ahead of consensus: We believe our view on revenue contribution from KPN is the primary reason for the difference in our and consensus estimates. Based on our channel checks, we estimate KPN to contribute 4.4% of the USD revenues of Tech Mahindra in FY14. In our view, Street numbers will be raised in the coming quarters, as KPN starts contributing to the company?s.

Increasing target price to R1,220: Our SOTP(sum-of-the-parts)-based target price now stands at R1,220. This is based on roll forward of earnings to FY13e/09 (vs. FY13e earlier). A key risk is project cancellation due to macroeconomic slowdown.

Valuation: With the availability of the audited and restated financials of Mahindra Satyam, we had reintroduced forecasts for that company. Moreover, a significant reduction in the uncertainty surrounding the potential liabilities has led to a corresponding reduction in the risk profile of Mahindra Satyam. We continue to value the constituent parts of the consolidated entity on a PE (price-earnings) basis with a 10% holding company discount for the stake in Mahindra Satyam. Given the improved revenue visibility for Tech Mahindra, we are marginally increasing its target PE to 11x one-year forward earnings (vs. 10x earlier). This partially takes into account the upside from a weaker rupee and margin improvements from operational efficiencies.

Risks: Key risks for Tech Mahindra are: (i) High vertical and client concentration, with more than 90% of revenues from communications service providers and within that, around 38% of revenues from a single client, BT. (ii) Currency fluctuation risk, with the bulk of earnings coming from exports (around 40% GBP-denominated). (iii) Risk of a potential global slowdown. (iv) Indirect liability from potential class action suits filed against Satyam.

Deutsche Bank