The Adani Group is not the only beneficiary of improved sentiments in the capital markets over the last couple of months. As the prospects of a Narendra Modi-led government have appeared to brighten, several other companies, especially those in the infrastructure sector, have made significant gains on the bourses.

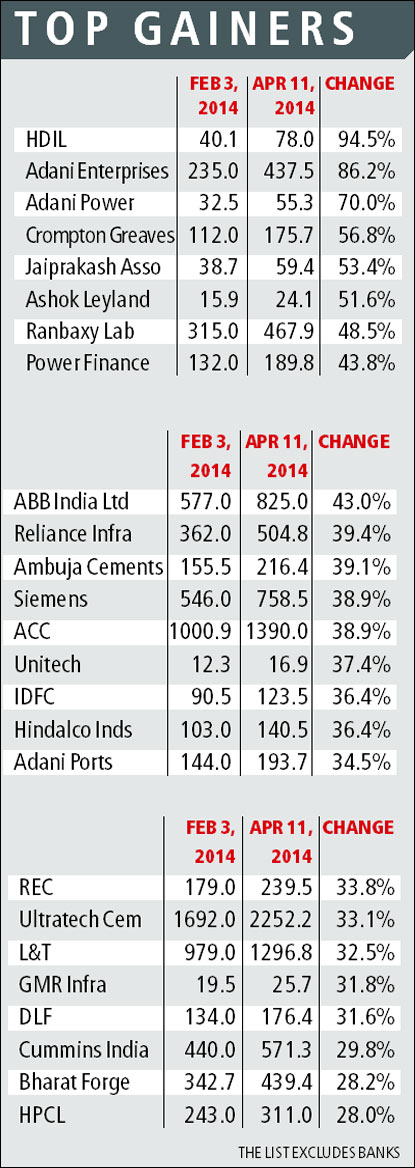

As many as 39 of the 100 companies that form the BSE100 have seen their share prices jump by more than 25 per cent. Several companies have outperformed the Sensex, which rose 10 per cent in the period from February to the end of last week.

Real estate major HDIL was the top performer, its stock gaining 94 per cent since February 2014.

Over the same period, Adani Enterprises rose by 86 per cent, and Adani Power 70 per cent.

Fifteen of the top 25 gainers (excluding banks) are infrastructure, capital goods or cement companies. Crompton Greaves and Jaiprakash Associates rose 57 per cent and 53 per cent, respectively, during the period. Ambuja, ACC and Ultratech are the

three cement firms in the top-25 list.

Infrastructure firms burdened by high debt, and unable to service it because of shrinking revenues and delays in project implementation, hope the tide will turn.

?Sentiment is turning positive as the prospects of a stronger mandate are getting better. Infrastructure and power were heavily battered through most of 2013, and there is expectation that a strong mandate will result in a decisive and clearer policy that will impact these sectors positively,? Pankaj Pandey, head of research at ICICI direct, said.

Banks, including public sector banks, too have gained at the stock market since February. Union Bank of India, Bank of Baroda and Punjab National Bank have risen by 47.6 per cent, 47 per cent and 41.8 per cent respectively. Shares of SBI, Canara Bank and Bank of India have risen over 25 per cent. ?Banks have huge exposure to infrastructure companies, and if the new government addresses the problems of infrastructure, it will bring relief to banks,? Pandey said.