Given how every depositor gets a digital debit card, Paytm Payments Bank has in less than a year of its launch notched up a large outstanding debit card user base.

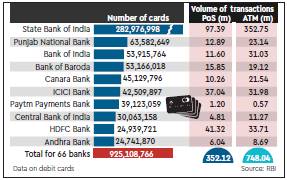

Reserve Bank of India (RBI) data show the mobile wallet-to-payments bank entity had 39.12 million outstanding debit cards at the end of May.

For perspective, private-sector majors HDFC Bank and Axis Bank had 24.94 million and 23.15 million debit cards in circulation at the end of May. To be sure, most of these these are physical debit cards.

The numbers at Paytm gain significance amid reports the RBI has asked Paytm Payments Bank to stop enrolling fresh customers and made observations about its customer on-boarding process and adherence to KYC or know-your-customer norms.

While Paytm’s debit card base tops that of some large banks, their usage is far more limited. In May 2018, Paytm’s debit cards were used to make just 1.2 million transactions at point-of-sale (PoS) terminals; the ATM transaction count was even lower at 0.57 million.

In contrast, HDFC Bank’s debit cards clocked 41.32 million PoS transactions and 33.71 million ATM transactions in the same month. Axis Bank debit cards were used for making as many as 23.05 million PoS transactions and 23.74 million ATM transactions in May.

Indeed, Paytm’s debit-card usage metrics fall short of even those at state-owned Central Bank of India (4.81 million PoS transactions, 11.27 million ATM transactions) and Andhra Bank (6.04 million PoS transactions, 8.69 million ATM transactions) which had fewer debit cards outstanding at the end of May than the payments bank.

State Bank of India (SBI) holds pole position in terms of debit cards outstanding as well as their usage. It had 282.98 million cards outstanding at the end of May, which were used to make 97.39 million PoS transactions and 352.75 million ATM transactions during the month.

FE had earlier reported that in January, Paytm had overtaken all banks in terms of the volume of mobile-banking transactions, accounting for nearly 22% of all transactions made through the mobile banking channel. It was followed by SBI, which has a 19.5% share in transaction volumes, Axis Bank (12.8%) and ICICI Bank (9.7%).