Mutual fund houses played it safe, increased their exposure to defensive sectors and chose not to tinker too much with their sectoral holdings in July as the equity market continued to remain volatile.

According to experts, fund houses chose to invest in companies with predictable earnings and businesses that avoided high debt and did not face cash flow issues.

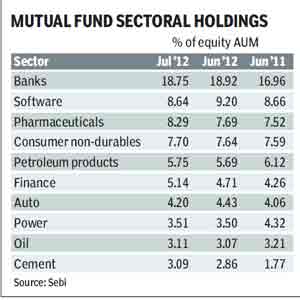

Mutual funds significantly upped their holdings in pharmaceuticals in July to 8.29% from 7.69% (as a percentage of their equity AUM) in June. They also significantly increased their exposure in the finance sector to 5.14% from 4.71% in the previous month and in Cement (to 3.09% from 2.86%). Marginal increase in stakes was seen in consumer non-durables, petroleum products, power and oil in the same period.

Mutual funds significantly upped their holdings in pharmaceuticals in July to 8.29% from 7.69% (as a percentage of their equity AUM) in June. They also significantly increased their exposure in the finance sector to 5.14% from 4.71% in the previous month and in Cement (to 3.09% from 2.86%). Marginal increase in stakes was seen in consumer non-durables, petroleum products, power and oil in the same period.

?The overall demand for pharma products has remained resilient even in times of economic turbulence. Also, the rupee depreciation and stable raw material prices have boosted margins of pharma companies,? said Gopal Agrawal, CIO, Mirae Asset MF.

MFs chose to reduce their holding in banks and software companies in the month of July. The exposure in the banking sector was brought down to 18.75% from 18.92% in the previous month. Exposure in software stocks was reduced significantly to 8.64% from 9.2% in the same period.

The holding in auto stocks was also cut down. According to experts, holdings in the software sector suffered as software firms faced pricing pressure in dollar terms and posted muted volume growth in the first quarter of FY13.

The top 10 sectoral holdings remained unchanged from the previous month except for the inclusion of cement in the top l0 list. The list is also similar to that of July last year, except for one notable change. The telecom sector, which featured at number 10 in July last year, has dropped to number 14, with its exposure reduced to 2.56% from 3.56% in the one-year period. Overall, the top 10 holdings constituted 68.18% of the MF?s total equity AUM in July compared with aggregate holdings of 67.98% last month and 67.82% in July 2011.

Mutual funds sold shares worth R1,901.8 crore in July, according to Sebi data even as the benchmark BSE Sensex retreated 1.1%. The uncertain political climate and the weak monsoons weighed on the sentiments in July. Also, institutional investors awaited the outcome of the Presidential elections, in the hope that the government would initiate fresh reforms after they were through.

Investors keenly awaited the RBI?s mid-quarterly monetary policy review on July 31.