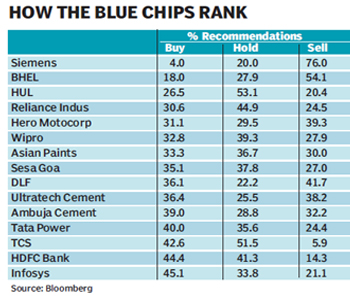

Even though several brokerage houses have revised their year-end targets for the 30-share Sensex after the government unleashed its much-coveted reforms plan, analysts still remain cautious on the earnings expectations of bluechip companies. For almost half of the 50-Nifty constituents, 50% or more analysts? recommendations are to either sell or hold the stock, shows a compilation of analyst ratings by Bloomberg.

According to this data, more than 50% of analyst recommendations for as many as 23 Nifty stocks for the year so far is to either hold or sell the stock. The list includes capital goods majors like Siemens, BHEL, and L&T, petroleum giant Reliance Industries, IT large-caps like Wipro, TCS and Infosys, among others.

According to this data, more than 50% of analyst recommendations for as many as 23 Nifty stocks for the year so far is to either hold or sell the stock. The list includes capital goods majors like Siemens, BHEL, and L&T, petroleum giant Reliance Industries, IT large-caps like Wipro, TCS and Infosys, among others.

Market observers believe that even as the recent policy announcements have made a positive impact on the market sentiment, leading to higher year-end targets for the benchmark indices, the earnings cycle may take some more time to revive, given the macro challenges in terms of slowing growth and higher inflation.

Earlier in September, as many as four foreign brokerages ? Ambit capital, Citi, Deutsche bank and Morgan Stanley ? raised their year-end Sensex targets towards 20,000 to 23,000 on expectations of higher foreign flows and improved future earnings. BofAML sees limited downside to the current fiscal earnings estimates of R1,210 even as it does not rule out some EPS downgrades for 2013-20114 that stands at about R1,410 currently.

As per Citi, the market trajectory suggests the Street’s willingness to upgrade the future earnings and there could be some normalisation of the bearish forecasts. However, it believes that fairly steady earnings of the September quarter and only moderately changing business outlook could keep the earnings upgrade in check. Capital goods stocks have emerged as the most disliked scrips. More than 50% of the total recommendations on both Siemens and BHEL are to sell these stocks, while almost a fifth of the analysts ask investors to hold them.

While lower order inflows and weak order books have in general impacted the investor confidence in capital goods companies, lower revenue visibility and sustained contraction in margins have led to downgrades for Siemens as analysts lowered their Fy13 earnings estimates of the company. Higher interest rates have also affected outlook on the short-cycle orders which account for almost half of the company’s revenues. While the recently announced debt restructuring of state electricity boards gave an impetus to BHEL, analysts are still weary of the impact of coal fuel linkages on the company?s order book. Collectively 82% of total recommendations on the stock are either ?hold? or ?sell? ratings.

Even Reliance Industries has witnessed an increasing number of downgrades from the start of the year, with as many as 45% of total recommendations being to hold the stock while a quarter of the total is to sell it.