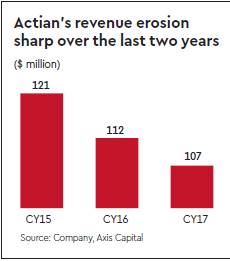

HCL Tech (HCLT) and Sumeru Equity Partners (SEP) announced the acquisition of Actian Corporation, a hybrid data management, cloud integration and analytics solutions provider. HCLT will own 80% and SEP will own 20% in the company. The acquisition will be all-cash deal for a total consideration of $330 mn. HCL Tech has valued Actian at 3.1x EV/Sales and 8.6x EV/Ebitda on CY17 financials. Revenue for Actian has been eroding at a CAGR of 6% over CY15-17.

M&As in fast lane

HCLT has spent $1.9 bn over the last three years to expand its presence in AM, consulting, BPO, cloud, and engineering services. HCLT will get $400-450 mn revenue contribution from acquisitions. Hence, a guidance of 10-12% y-o-y revenue growth for FY19 implies 5-7 % y-o-y organic growth implying limited recovery in revenue trajectory.

Key highlights

Product/platform for cloud/IoT: The acquisition is part of HCL Mode 3 strategy to augment its capabilities in data management products and platform. Actian incorporated in 2005 has product portfolio such as Actian Vector (columnar database), Actian DataConnect (a hybrid cloud data integration platform), Actian X (hybrid database for next generation operational analytics) and Actian Zen (an embedded database for IoT), to manage end-to-end data lifecycle. Headquartered in Palo Alto (CA), Actian has 275+ employees spread across US, UK, Germany, Japan, and Australia.

Eroding revenue but margin and earnings accretive: Actian revenue has been eroding at a CAGR of 6% over CY15-17 to $107 m in CY17 (from $120.6 m in CY15). The company reported Ebitda margin of 36% in CY17. HCLT will own 80% stake, SEP will own 19.5% and Actian CEO will own 0.5%. The deal is valued at 3.1x EV/Sales and 8.6x EV/Ebitda on CY17 financials. We see deal to be margin and earnings accretive (1% positive impact).

Organic growth concern lingers

HCL Tech inorganic strategy has been stronger compared to its tier-1 peers. HCL Tech has been plugging the gaps in its services portfolio through acquisition of business from its clients (Volvo, Merck etc). The company has not paid expensive valuations for its acquisitions excluding IP partnership (wherein it spent `1.2 bn for ~$250 m of revenue) and Actian when the company has paid 3x sales. However, the company has failed to ignite its organic growth. Growth across the services ADM (Q3FY18: 7.2% y-o-y), IMS (Q3FY18: 5% y-o-y), BPO (Q3FY18: 5.4% y-o-y) remain at mid-single digit. We expect $400-450 m (C3i: $199 m, Actian: $107 m, IP: $125 m) contribution from the inorganic booster by the company that implies a revenue guidance of 10-12% y-o-y in USD term would translate into 5-7% y-o-y organic revenue growth.

Valuation & recommendation

We believe Actian acquisition would strengthen HCL Tech Mode 2 and Mode 3 strategy. Moreover, it will strengthen their product platform strategy. The strong clientele of Actian would offer cross selling opportunities. However, weak organic revenue growth compared to peers raises concern on the company’s ability to mine existing clients and cross sell services. We expect USD revenue CAGR of 10% over FY17-20 and earnings CAGR of 7.5% over same period. We reiterate our Hold rating with revised target price of `1,030, valuing it at 14x FY20e earnings.