With the Reserve Bank of India (RBI) having upped the key policy rate by 50 basis points to 8% on Tuesday, the eleventh time since March 2010, bankers are not just bracing for another round of rate hikes or a hit to their margins but also slower credit growth.

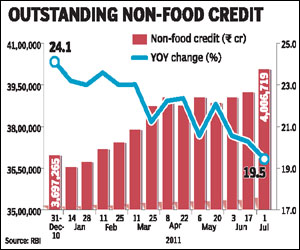

The central bank made it clear in its monetary policy review on Tuesday that it wanted non-food credit to grow at a slower 18% this year rather than the 19% that it had earlier projected.

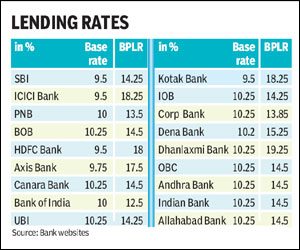

Aditya Puri, managing director and CEO HDFC Bank, observed that lending rates would certainly go up. ?Yes, interest rates will go up though it?s hard to say how much. Our costs are going up and we have to take into account the RBI?s concerns on demand pressures stoking inflation.? Puri was addressing a press conference together with other bankers. Pratip Chaudhuri, chairman State Bank of India observed that the hike in key policy rates is to be passed on to borrowers.

?Everything will be passed on and we will have to assess what kind of impact, a 50 basis points increase will have on our cost of funds,? Chaudhuri said adding that the slowdown in home loans would be cushioned by the sanctions given so far. Bankers believe that since the cost of deposits too would go up, there could be some pressure on margins. Said Alok Misra, CMD, Bank of India, ?There would definitely be pressure on margins if youa re not able to pass on the entire cost of deposits.?

The prospects of slower growth have also given rise to concerns on rising non-performing loans, some of them in the infrastructure space. However, they are reassured that while npls may rise there is no systemic risk. KR Kamath, CMD, Punjab National Bank asserted that there was pressure on asset quality. ?We have demanded that the npl classification should be delinked from date of commencement (CoD) and should be linked to cash-flow and generation. It?s possible there would be npl accretion in capital intensive sectors like real estate, education loan, infrastructure and vehicle loans. MD Mallya, CMD, Bank of Baroda observed that credit growth has been slowing down with new projects not taking off.

?It?s too early to say we have problems with our exposure to infrastructure but there are challenges with loans to the power sector.? Mallya pointed out that for rate -sensitive sectors, the pressure comes with a lag. ?Going forward, the lag effect needs to be considered so one could see increased pressure as far as asset quality of the industry is concerned,? he said. MV Nair, CMD, Union Bank felt that this time around corporates are able to pass on the interest rate increase. ?Where we may have problem with npls is with companies that are highly leveraged companies and also SMEs where the margins are low,? Nair pointed out adding that the situations in 2008 was not comparable with today. Puri pointed out that since salaries were increasing there was no question of restructuring home loans. ?The increase in EMI will be lower than the incremental rise in inflation? Puri said.

Bankers are also worried that they would lose business from top corporates which would prefer to access the overseas markets for their requirements.

?These days corporates are saying they don’t want rupee denominated credit. Instead they are asking for a guarantee so that they can access three year loans from overseas markets,? pointed out SBI?s Chaudhuri.