A sudden rush to sell distressed assets to asset reconstruction companies (ARCs) in Q4 could be attributed to the RBI allowing banks to write back the excess provisions made over the book value when the NPL is sold, says an HSBC report.

Earlier, if the sale was for a value higher than the net book value (NBV), the excess provision was not allowed

to be reversed, but banks were to utilise the same to meet the loss on account of sale of other financial assets to ARCs.

HSBC pointed out that another reason for the large volume of NPA sales is the mounting stress in the banking system where impaired assets currently stand at over 10%, consisting of 4.2% gross NPLs and 6% restructured assets.

?This harks back to the early 2000 when gross NPLs were at similar levels and there was no concept of restructured loans then. Thus, for problem loans that are complex to resolve by any bank individually, many banks have now resorted to offer it to ARCs for more efficient resolution as ARCs have dedicated resources to follow up and recover these loans,? the report said.

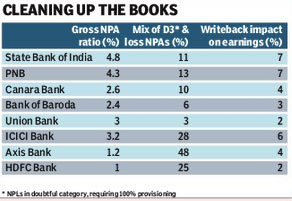

The report predicts that banks would prefer to transfer NPLs categorised as D3, or doubtful category requiring 100% provisioning, as well as loss assets, as whatever value they obtain from ARCs would effectively be written back through their income statement, boosting earnings and capital adequacy up front. However, HSBC said that there are limitations to the sale of assets as the amount of total D3 and loss assets available in the system is not very huge, as banks would prefer to sell these fully provided assets first followed by other NPL categories.

?Our estimate of the total D3 and loss assets in the system is R34,000 crore (about 13% of total NPLs) of which R17,000 crore has already been taken up. Assuming all of this consists of D3 and loss assets, the remaining available for sale is R17,000 crore,? it added. Another limitation is on how much capital do ARCs have to buy these stressed assets. ARCIL, which has a 70% market share, has a capital base of R1,500 crore of which about R1,000 crore is already committed to existing NPLs.