So many conferences are held in Hong Kong that it is hard to believe one could ever be full. Yet in mid-November the Asian Venture Capital Journal (AVCJ) was forced, with regret, to turn away customers from its private-equity meeting. There was simply no room for the hordes of European and American investors stopping in Hong Kong on their way to China.

Three widely held opinions about China (it?s big, expanding and filled with entrepreneurs) and some spectacular returns on deals mean many buy-out big-shots are reinventing themselves as China hands. Capital-raising, trivial a decade ago, is booming after a blip in 2009 (see chart). So far this year China-focused funds have accounted for more than 9% of global fund-raising, up from 1% in 2007, according to Thomson Reuters, an information firm.

The usual suspects, including Carlyle, TPG, KKR and Blackstone, have set up China-related operations. All told, there are 167 registered foreign managers of private equity funds in China and 265 domestic ones, according to Asia Private Equity Research, up from almost none a decade ago. Estimates of China?s unregistered firms bounce from 3,000 to 10,000 and above. Many prominent local and Western firms are populated by the children of China?s leaders, who bring powerful connections and a degree of political protection.

There is a gap in China?s financial system that private equity can fill. Most capital is channelled through state-controlled banks that offer low returns on deposits and cheap loans to state-controlled companies. Both savers, who want better returns on their investments, and entrepreneurs, who need capital, should be keen on bypassing the state-bank system.

There is a gap in China?s financial system that private equity can fill. Most capital is channelled through state-controlled banks that offer low returns on deposits and cheap loans to state-controlled companies. Both savers, who want better returns on their investments, and entrepreneurs, who need capital, should be keen on bypassing the state-bank system.

China is also particularly seductive for Western buy-out firms. They are keen to find new deals there, now that the boom in leveraged buy-outs in rich countries is over. They also want to ensure that the companies they already own do more business in the Middle Kingdom. Blackstone recently held a gathering in China for 33 chief executives of its portfolio companies to discuss, among other things, how to expand their activities there.

Western private equity firms are also keen to raise new capital from China. Yuan-denominated funds, recently made available to non-Chinese firms, face less red tape and enable private equity outfits to team up with local governments to raise money and help locate deals. The largest American firms are all keen on developing such vehicles.

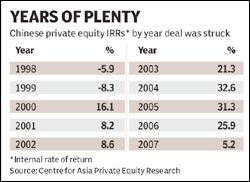

To the extent that aggregate records for private equity returns exist, results in China are strong. At best, however, these are only vague indicators. Since the industry is new, the sample of deals is pretty small. Because of the pervasive opacity of China, failures are quietly buried. And concern about criticism from Marxist die-hards means that even successes are often hidden.

Those deals that do get attention tend to be big, successful and involve foreign firms. In June TPG sold a controlling stake in Shenzhen Development Bank for many times its original investment. On a percentage basis, Baring Private Equity is thought to have made even more on an investment in Hidili Industry, a coal producer that was recently refinanced. TPG will probably make another fortune if, as planned, a public offering goes through for Grand Auto, a car-dealership chain in second-tier cities. Carlyle got a rare opportunity to invest in a leading insurance company, China Pacific Life, and made a killing when the insurer listed in Hong Kong last year.

A further relaxation of capital-raising rules is another boon. In August officials lifted a restriction on registered insurance companies placing money with private equity firms: they may now invest up to 5% of their assets this way. And yuan-denominated funds may eventually be opened to non-Chinese investors.

No one does indiscriminate bullishness better than the private equity industry. Yet for all the buzz, the reality of operating in China is likely to test even its professional optimists. For a start, three of the techniques buy-out shops often use in the West?dismemberment, leverage and tax avoidance?are unfeasible in China.

There ain?t no RJR Nabiscos here

Gaining control of acquired companies, which is usually deemed essential for buy-outs, is also difficult. Many industries are considered ?strategic? and therefore off limits, or open to investment only in exceptional cases, such as finance. Across all sectors a typical Chinese private equity investment is a non-controlling stake of 15-40% in an operating company, with the money intended (but not always used) as growth capital. For dollar-based funds, which had been the norm until yuan-denominated ones took off, laborious government approvals are required to close deals. These can take months or even years. Those who have attempted to take a majority stake in a company, as Carlyle did in 2005 when it tried to buy 85% of Xugong Group Construction Machinery, China?s largest maker of building machinery, have tended to fail.

Given these hurdles, finding suitable investments is hard. KKR raised a $4 billion Asian fund in 2007 that, at the time, was supposed to be largely focused on China, but it is widely believed that only a fraction of the money has been spent. Since 2005 private equity firms have raised more than $57 billion for investment in China, according to Preqin, a research firm, but much of that is thought not to have been deployed.

As a result, too many firms are chasing too few deals. One executive at a leading American buy-out firm says that, more than any potential regulatory issue in China, he is concerned about the ?intense amount of competition? from local firms, which outmanoeuvre Western firms on deals and also poach their staff.

Faced with the problem of finding suitable private targets, many of the bigger firms have turned to PIPE deals: the acronym stands for ?private investments in public equity?. These typically involve buying a large slice of a Hong Kong-listed company. That avoids the drudgery of sorting out a private firm, but makes it rather hard to justify large fees. The alternative is gruelling: doling out stakes of $5m-10m and certainly no more than $100m, and only after painstaking due diligence.

Victoria Capital, a small firm whose managers have a long history in China, invests only after reconstructing a target company?s financial statements using original receipts. Arc China, another small firm with experienced managers, invests only in companies which collect revenues in an obviously verifiable way, such as a retail company that receives fees from franchisees at a single point, rather than from a string of wholly owned stores.

Steven Barnes, managing director of Bain Capital, a private equity firm, told attendees at the AVCJ conference that it takes twice as many people to manage investments in China as in the West. That may be optimistic. What is more, one of the most important parts of private equity investing can barely be managed at all. Since firms typically hold only a minority stake, their ability to realise money for their holdings is limited. Recent returns have been almost entirely the result of a strong market for initial public offerings in Asia, which has allowed insiders to receive large payouts. Citigroup reckons that 30% of the recent offerings were backed by private equity firms, with China heavily represented. If the market flags, that door will shut and the next round of successful conferences in Hong Kong may have less to do with tips on getting into China than with advice on getting out.

? The Economist Newspaper Limited