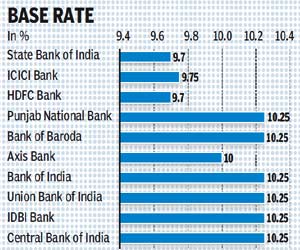

Central Bank, Bank of Baroda, Bank of India cut base rate by 25 bps each

Following suit of other large public sector lenders, Bank of Baroda, Bank of India and Central Bank of India have also reduced their respective base rates by 25 basis points (bps) each, bringing them down to 10.25%, on Friday.

The move aims at passing on the benefit of the wider policy rate cut by Reserve Bank of India (RBI) to customers.

The move aims at passing on the benefit of the wider policy rate cut by Reserve Bank of India (RBI) to customers.

The base rate is the rate at below which banks cannot lend to its customers. A cut in the base rate implies all borrowers, both existing and new, will benefit from lower rates. Borrowers pay interest a few percentage points higher than the bank?s base rate.

The base rate cut is likely to boost the retail business of banks, making loans more attractive.

The retail loan portfolio, that had so far helped banks salvage their credit offtake amid deceleration in disbursals to the industry, showed signs of slowing down in December indicating that consumers are tightening their purses.

In December, banks’ retail loans grew 13.7% year-on-year, slower than the 16.3% clocked a month ago, RBI data showed. The slowdown was on account of a 36% year-on-year fall in loans for purchases of consumer durables compared with a 28% growth in the previous year.

Along with this, the three state-run lenders have also reduced their benchmark prime lending rates (BPLR) by 25 bps each to 14.5%. The new rates will be effective from February 9, the banks said.

Punjab National Bank and Union Bank of India had reduced base rates by 25 bps each, bringing them down to 10.25% respectively, on Thursday.

On Wednesday, State Bank of India (SBI) lowered base rate by 5 bps to 9.7%. However, private banks like HDFC Bank and Federal Bank had announced cut in rate on their vehicle loans.

Immediately after RBI?s policy rate cut on Tuesday, IDBI Bank and RBS had cut base rate by 25 bps to 10.25% and 75 bps to 9%, respectively. IDBI Bank also reduced its BPLR by 25 bps at the same time.