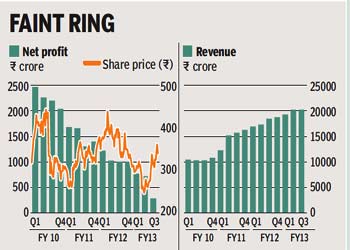

Net declines 60.61% sequentially to Rs.284 crore

The country?s largest telecom operator Bharti Airtel on Friday missed analysts? estimates while registering a 60.61% sequential decline in net profit for the October-December quarter at R284 crore. The company had posted a net profit of R721 crore in the preceding quarter. On a yearly basis the decline in net profit was 72%. On a sequential basis the company?s total revenues also declined 0.17% at R20,239 crore. However, on a yearly basis it was up 9.5%. The company?s Ebitda margin at 30.6% was lower than the preceding quarter?s 31.3%.

The disappointing earnings pulled down the company?s share, which closed down 2.62% at R330.50 on the BSE.

The disappointing earnings pulled down the company?s share, which closed down 2.62% at R330.50 on the BSE.

This is Bharti?s 12th successive quarter of declining profits. The decline in profitability was attributed to higher finance cost, including forex losses and tax outgo. Explaining the steep fall during the quarter, the company management said that in the previous quarter it had benefited due to a favourable ruling from the Telecom Disputes Settlement and Appellate Tribunal in an interconnect dispute. The gain to revenues on account of this in the preceding quarter was R586 crore, while contribution to the profit before tax number was R344 crore and to net profit R238 crore. The company maintained that on operational parameters the company was faring well as the worst was over since it reported a sequential increase in average realisation per user (Arpu) and data usage. It added that the tariffs wars were over and, in fact, steps had been taken to adjust tariffs in a manner that realisations increase.

The company?s board also approved the proposal to make Manoj Kohli the managing director (international operations) while elevating the newly appointed CEO of the India operations Gopal Vittal as the joint managing director. Vittal will also come on the company?s board of director as additional director. Sunil Bharti Mittal, who is the company?s chairman and managing director, will now be the executive chairman with both Kohli and Vittal reporting to him.

Mittal acknowledged that tough market conditions are putting pressure on margins. ?Market conditions have been challenging in recent quarters due to pricing pressures and rising input costs, which have put enormous pressure on the sector and, consequently, the margins. However, the worst seems to be getting over with corrections taking place in customer acquisition practices and tariffs, which are driving quality of acquisitions and improving efficiencies. Moreover, on the data front, it is heartening to see strong (quarter-on-quarter) growth and across geographies,? Mittal said in a statement.

During the quarter, Bharti?s net finance cost rose 69% on a yearly basis to Rs 1,331 crore. Forex losses stood at Rs 248 crore against a gain of Rs 13 crore in the preceding quarter. Income tax expenses rose 20% to Rs 667 crore. Explaining the increase in financing cost, Kohli said, ?The net financing cost has primarily increased because the dollar cost incurred in Africa when translated into rupees has gone up and secondly, because of the hike in the borrowing rate.?

The good news on the operational side was the 4% quarter-on-quarter increase in Arpu at Rs 185 against the preceding quarter?s Rs 177. The monthly churn rate also came down 5.9% against the previous quarter?s 8.5%.

The minutes of usage also increased to 435 against preceding quarter?s 417, signifying that traffic is returning to the network. This maybe because increasingly, mobile firms are deactivating inactive customers. The other positive trend is the growing trend of data customer base and increasing Arpus here. The company?s total data customer base during the period increased to 41,480 against the preceding quarter?s 40,600. Of this the 3G customer base was at 5,187, compared with 4,014 a quarter earlier. The data Arpu at Rs 47 was 9% up on a quarterly basis. Recently, the company also adjusted its tariffs upwards in a manner that its realisations improve.

In the near term, the company expects stability with an upward bias on the tariff front because the overcrowding in the market has diminished with a host of cancellation of licences by the Supreme Court last year. The fresh auction that took place in November did see some players re-enter the market but only in select circles. With the monthly gross addition of subscribers coming down, there?s not much pressure on the operators to lower tariffs.

Analyst maintain that while such a move and trends are good, the real drag on the company in the coming quarters would be the finance cost due to the debt it took to acquire the African operations of Zain. Further, the African operations still continue to post net losses.

On the domestic front, regulatory costs continue to be a risk factor since the company has to pay a one-time charge for spectrum beyond 4.4 MHz, which is around Rs 5,200 crore. The company is also likely to participate in the auctions for the 900 MHz spectrum in March. It would have to renew its Delhi and Kolkata licences this year by paying the auction rates in the 1,800 MHz band. For the time being the company has obtained a stay order till the end of the month from the Bombay High Court over paying the one-time fee.

The African operations recorded a 15% rise in revenue at Rs 6,169 crore, compared with the Rs 5,357 crore reported a year earlier. However, losses almost doubled to Rs 520 crore from Rs 259 crore in the December quarter of 2011.