Smaller raw materials bill rescues profits as revenues hurt by sluggish volumes

The sales side of the story at India Inc has taken a turn for the worse. The rise in revenues in the three months to September has been hurt by sluggish volumes and lack of pricing power; even a year ago, revenues were growing at more than twice the current pace. If earnings have grown faster than they did in the June quarter, it is because companies have cut back on costs and paid out less for raw materials and interest. In short, the earnings season has been disappointing so far with very few companies reporting exceptional numbers.

The good news has been the 30% year-on-year jump in engineering heavyweight Larsen & Toubro?s order book, a sign perhaps that the capex cycle may be turning, However, the lacklustre volume growth reported at FMCG major Hindustan Unilever of just 7% year-on-year for the domestic consumer business means high inflation continues to hurt households.

The good news has been the 30% year-on-year jump in engineering heavyweight Larsen & Toubro?s order book, a sign perhaps that the capex cycle may be turning, However, the lacklustre volume growth reported at FMCG major Hindustan Unilever of just 7% year-on-year for the domestic consumer business means high inflation continues to hurt households.

With disposable incomes weighed down by inflation, the consumer durables sector is also in trouble. Not too many players are exhibiting pricing power and volumes are clearly under pressure ? Hero MotoCorp reported a sharp drop in net profits of 27% year-on-year; revenues for the two-wheeler maker were down 11 % on an annualised basis in the wake of a 14% drop in volumes. Peer Bajaj Auto did slightly better, reporting a drop in net profit of 3.5% y-o-y on the back of smaller volumes that fell 10% y-o-y.

Discretionary spends are definitely slowing down; although Asian Paints? revenue were up 16%, analysts estimate just 8% came from higher volumes. And companies are compelled to spend more on advertising ? operating profit margins at Dabur were down 180 basis points y-o-y as the firm forked out more money to push its brands. Raymond?s Ebitda (earnings before interest, taxes, depreciation and amortisation) margins contracted 280 basis points y-o-y and the reported PAT fell 38%.

Among those coping well in a challenging global and local environment are firms like Tata Consultancy Services and Mahindra & Mahindra. But many are struggling including Adani Power, which posted a recurring loss of R500 crore due to high fuel costs and loss-making power purchase agreements. Competition in sectors such as telecom continues to hurt: Idea Cellular disappointed analysts as lower traffic saw revenues fall sequentially resulting in an anaemic Ebitda.

Sterlite turned in a moderately good show with copper, aluminium and zinc faring well; the firm was helped by a stronger rupee that helped push up reported profits.

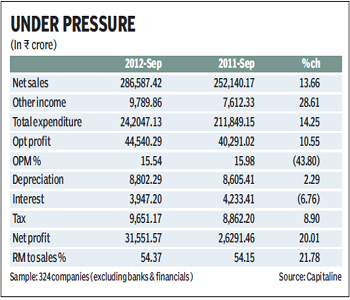

If despite this earnings in the September quarter have grown at a good 20% y-o-y, compared with June 2012, it?s because corporates have managed to cut back on expenses ? costs have risen a shade over 14% compared with a near 20% rise in the June quarter. And the raw materials bill is up just 22 basis points y-o-y compared with 105 basis points y-o-y in the June quarter and a sharp increase of 322 basis points y-o-y in the March quarter. For a clutch of 324 companies (excluding banks and financials), net sales, though have risen a poor 13.7% y-o-y in the three months to September, compared with the increase of 16.7% % y-o-y seen in the June quarter.

Mahindra & Mahindra posted a splendid set of numbers exhibiting pricing power both in the SUV and tractor spaces; revenues rose a robust 25% y-o-y and Ebitda margins were a shade short of 14%. That?s despite tractor volumes fell 13% y-o-y while tractor revenues fell 6% y-o-y.