Share prices of domestic stock-broking firms have rallied sharply since September on the back of improved cash market volumes and reform measures initiated by the government.

The average cash market volumes for September on the the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE) stood at R14,285 crore, highest since March this year (R15,236 crore). This is much higher than the six-month average of R12,195 crore.

The average cash market volumes for September on the the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE) stood at R14,285 crore, highest since March this year (R15,236 crore). This is much higher than the six-month average of R12,195 crore.

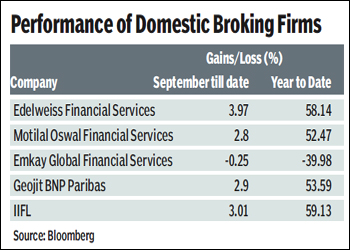

In fact, shares prices of broking majors, such as Edelweiss Financial Services, Motilal Oswal Financial Services, IIFL and Geojit BNP Paribas, are up as much as 50% in the year to date.

This is despite the fact that the aggregate income of the top 124 broking houses declined 18.6% year-on-year to R3,205.49 crore during FY12 and and aggregate net profit eroded 38.3% to R427.38 crore during the same period, according to Dun & Bradstreet India (D&B India). The benchmark BSE Sensex is up more than 20% in the year to date.

?Broking scrips were beaten down way below their fair value and the bounceback in the benchmark indices in 2012 have brought them back in the limelight,? said Prasanth Prabhakaran, president, retail broking, IIFL.

The outperformance could also be attributed to the reduced dependence of these firms on broking income and the thrust on diversification into areas, such as retail lending and wealth advisory. According to estimates made by rating agency Crisil, these businesses could contribute 50% of the broking houses? profits in 2012-13 against 25% in 2010-11.

Analysts believe that this might be a good time to look at broking stocks again. ?Indian brokers are trading at trough multiples relative to both their history and global peers. We?re not expecting a dramatic recovery, but we do think the majority of the risks have played out, capacity is coming out and current valuations are too bearish,? stated a recent research report by Espirito Santo Securities.

The past two years have been tough for domestic brokerages. The share of high-yielding cash volumes has declined from 30% in FY08 to less than 10% in Q1FY13 and the share of the low-yield options segment in F&O (futures & options) trading has increased from 10% in FY08 to 70% in Q1FY13. As a result, the blended yields have been falling.

?Broking stocks have been ignored by investors over the last couple of years, given low market volume and a paucity of IB deals, leading to 25% under-performance against the BSE-200 since January 2011,? pointed out analysts Santosh Singh and Nidhesh Jain from Espirito Santo Securities.

Experts feel the broking scrips will continue their good run if the Indian equities continue their uptrend and FIIs continue to invest. ?We see signs of the market stabilising and if confidence returns, then a continuation of this rally and a re-opening of primary equity markets could lead to a substantial rerating of these stocks,? said the analysts from Espirito Santo.