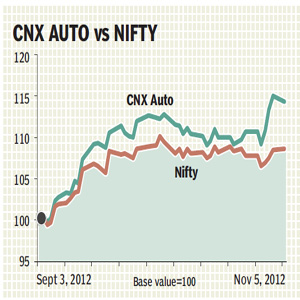

Following strong October sales, auto stocks have turned a popular bet among traders. In the last one and half months, CNX Auto, the sectoral index on the NSE, has outdone the benchmark Nifty by nearly 6%.

On hopes of festive demand adding to their volumes during November, stocks like Bajaj Auto, Maruti Suzuki and Mahindra & Mahindra touched 52-week highs as they rallied 4-7% last week.

On hopes of festive demand adding to their volumes during November, stocks like Bajaj Auto, Maruti Suzuki and Mahindra & Mahindra touched 52-week highs as they rallied 4-7% last week.

Analysts expect auto stocks to see favourable interest from the investors in the near-term. However, they say that it could be too early to term the revival of the October sales as a trend.

According to Nomura, while there were concerns regarding a further slowdown in the passenger vehicles and two-wheeler segment, the October sales numbers were better than expected. ? This could be an initial sign of demand stabilising, even as it is too early to give a verdict,? it said in a report analysing the October sales number.

As per the aggregate volume numbers of seven auto producers, compiled by Motilal Oswal, light commercial vehicles (LCVs), cars and utility vehicles (UVs) experienced the strongest y-o-y growth of 60%, 53% and 45% during October. However, two-wheelers and motorcycles witnessed flat volume growth of 2.5-3% compared to the same month last year, while tractors and medium & heavy commercial vehicles (MCV) sales growth fell during the month.

Growth in passenger vehicle and two-wheeler segments is believed to be supported by retail demand due to Dussehra in October. On the other hand, freight availability and rates continue to weigh on the demand of the commercial vehicles, especially that of MCVs.

The biggest volume surprise was posted by Maruti with a 87% growth in domestic volume growth, albeit on a weaker base. The company also reported its September quarter numbers, which, at a 5.4% y-o-y decline in net profit during the quarter, was better than Street estimates. The stock was upgraded by at least six brokerage houses in October including, Deutsche Bank, Jefferies and HSBC. While Mahindra & Mahindra continued its strong sales performance in categories like UVs and tractors, Tata Motors? domestic volumes were dragged down by Pvs and MCVs.

The performance of auto stocks since mid-2011 was largely affected by slowing demand, higher interest rates (lending rates), volatile rupee, rising fuel costs and rising competition in the domestic market, especially in the passenger vehicle category.

Companies like Maruti and Hero Motocorp, on the other hand, faced specific issues related to labour unrest and falling market share after termination of the Honda partnership. As a result, the stocks got de-rated with about 45-60% of the analyst ratings being sell and hold on these stocks.