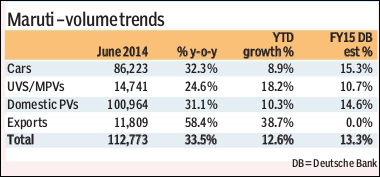

Maruti Suzuki’s June 2014 volumes at 112,773 units (+33.5% y-o-y) are strong. Domestic volumes were at 100,964 units (+31.1% y-o-y) while exports were at 11,809 units (+58.4% y-o-y). The strength in numbers is driven by a significant recovery in entry segment volumes (+52 % y-o-y) in June.

We are forecasting industry demand revival over FY15-17e (15% per annum) and expect Maruti (domestic growth of 16% p.a. over FY14-17e) to increase its market share to 43.4% (vs. 42.1 % in FY 14). Maruti?s YTD (year-to-date) volume growth at 12.6% y-o-y is marginally below our FY15 forecast of 13.3%. Our FY15 forecast implies an average monthly run-rate (MRR) of 112,076 units over the next 9 months against the YTD run rate of 99,965 units.

Key highlights

n Entry segment (Alto/WagonR) volumes grew by a robust 52% y-o-y to 47,618 units (highest monthly volume in over two years). This segment has been weak in recent months after showing relative resilience during the first three quarters of FY14. Our forecast of 6.4% volume growth in FY15 implies a MRR of 38,117 units for the remaining 9 months vs. YTD MRR of 34,243 units.

n Premium compact (Swift, Ritz, Celerio) volumes at 22,293 were modest compared to the growth in the past few months. Our forecast of 39% growth in FY15 implies a MRR of 30,878 units over the next 9 months vs. YTD MRR of 24,115 units.

n Entry sedan segment (Dzire) volumes were at 15,990. Our forecast of 12% growth in FY15 implies a MRR of 18,940 units over the next 9 months vs. YTD MRR of 16,984 units.

n UV segment (Ertiga) at 5,003 units. Our forecast (12% growth) implies a MRR of 5,903 units for the next nine months vs. YTD MRR of 5,089 units.

Maintain Buy on competitive positioning and expectation of demand revival. We maintain our Buy rating with a target price of R2,700. The stock currently trades at 15xFY16e EPS.

?Deutsche