Q2FY14 review?pockets of strength yes, but weak overall: Q2FY14 was another quarter of deceleration in volume, revenue, Ebitda (earnings before interest, taxes, depreciation and amortisation) and PBT (profit before tax) growth for our Indian consumer coverage universe. On the demand front, there were pockets of strength that surprised us a bit?the strong volume growth reported by paints companies and sustained mix improvement by packaged foods. Gross margins were generally better than expected but failed to translate into Ebitda beat as increased A&SP (advertising & sales promotion) and overheads took their toll. Valuations have corrected a tad but not enough for us to change our Cautious overall stance; estimates remain optimistic.

Another quarter of growth deceleration: The Sep 2013 quarter was a mixed bag for the Indian fast-moving consumer goods universe?(i) growth slowed down further and Ebitda/PBT growth decelerated too despite healthy gross margin expansion, and (ii) select categories and companies performed better than expectations even as composite growth metrics decelerated further. Revenue growth slipped to 10.5% (weighted-average for KIE?Kotak?universe), Ebitda growth to 13%, and PBT growth to under 14%. Net income growth was 12.7%, a tad higher than Q1?s 11.8% ? primarily on the back of lower ETR (effective tax rate) jump year-on-yeat (versus Q1 jump).

Quick thoughts on key parameters

*Volumes?deceleration continued, especially in most of the HPC (soaps, laundry, hair care, etc.) and discretionary categories. Key categories that sustained volume growth momentum were oral care (did P&G-launch-induced promotions surge aid volume growth a tad?), paints (sector wise positive surprise) and value-added hair oils to some extent.

*Channels?urban growth, especially in metros and tier-1/2 cities, slowed down further even as growth momentum remained healthy in tier-3/4 towns and rural areas. CSD (canteen store department of military) growth was strong, perhaps aided by a low base, while most companies indicated weak modern trade growth.

*Margins?strong 187 bps y-o-y gross margin expansion on a weighted-average basis for our coverage universe?aided by benign RM (raw material) index, primarily. We believe that the impact of rupee depreciation has not shown up on gross margins yet, even as some companies indicated otherwise. At an Ebitda level, margin expansion was a much lower 47 bps?impacted by higher A&SP and other expenses, primarily. We expect A&SP to remain high while persistent high inflation in some of the key fuel-linked overheads (freight, power & fuel, etc.) could keep other expenses on the higher side as well.

*Demand outlook?cautiously optimistic, still. Companies continue to see good monsoons and elections as triggers for demand acceleration?while we agree conceptually, historical empirical evidence is inconclusive, at best.

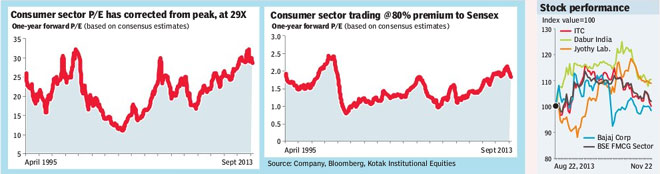

*Stay cautious: Despite correction in most FMCG stocks over the last month, FMCG sector is trading at rich valuations of 29x (times) one-year forward earnings and most stocks are trading at 10-40% premium to their five-year average multiples. We see margin pressures ahead in the form of (i) higher input costs due to rupee depreciation, (ii) inability to take price hikes (macro-headwinds), and (iii) higher A&SP due to competitive pressures. We remain Cautious on the sector. ITC remains our top large-cap pick while we like Dabur, Jyothy Lab and Bajaj Corp among the mid-cap names.