Cement pricing lacking momentum: Our conversations with dealers seem to suggest a lack of pricing momentum and confusion around the general direction, with hikes and cuts being announced in a span of days and not much change in the demand situation. Demand continues to remain muted; dealers have cited issues such as lack of pre-election spend, political agitation, sand mining ban, and shortage of labour. Supply may rise in December as some companies have a December YE (year-end); most dealers are expecting improved demand-supply dynamics by early CY14.

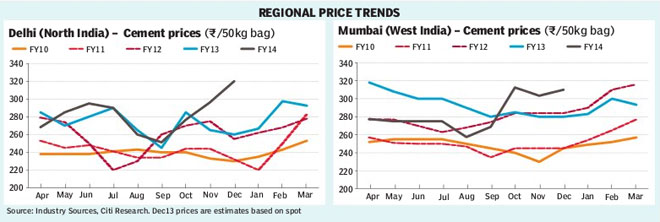

Pricing?slight increases in the north and west: North: Prices in Delhi have wavered through November, but have been raised by 7% to R320/bag for December. Dealers are skeptical about the sustainability of this hike and mentioned there has been no spurt in demand as a result of the elections.

West: Mumbai prices have been raised by 3% to R310/bag; demand continues to remain muted.

South: Prices in Hyderabad are stable at R280/bag?production discipline is continuing; demand is weak exacerbated by the lack of government spending and political agitation. Prices in Chennai have fallen marginally (3%) to R320/bag, sand mining issues have continued to persist.

East: Demand trends in Kolkata have also been disappointing with limited revival post-monsoon, lack of spending and labour shortage. Prices have corrected by 2% to R320/bag.

Apr-Oct13 demand growth 4%: According to the ministry of commerce and industry, India?s cement production grew 4% during April-October13 vs. GDP growth at 4.6%. Cement production growth in October remained subdued at 1%. We forecast FY14 demand growth at 5%, demand-supply gap to widen (110mt in FY14e vs. 100mt last year) with utilisation at record lows (<70%).

Sell UltraTech Cement

: We expect pricing to be volatile; the fight for market share may resurface as chunky capacities are expected in H2. Ultratech continues to lose market share?H1 domestic volumes at 19mt were flat year-on-year vs. national demand growth of 4.5% during Apr-Sep13. At $162 EV/t (on capacity of 57mt), valuations appear expensive.

We set our target of R1,475 for Ultratech at 10x Sept14e EV/Ebitda (enterprise value/earnings before interest, taxes, depreciation, and amortisation)- at a premium to peers (in line with the spread over the last year). Ultratech (under-load tap changer) is not exposed to the uncertainty associated with royalty payments as is the case with some other cement producers. At our target price, Ultratech would trade at 16.6x P/E (price-to-earnings ratio) and an EV/t of $134 (on 57mtpa of capacity, R/$ rate at 60) vs. replacement cost of $110/tonne.

Risks: A 1% change in cement realizations impacts profit after tax by 5%; 1% change in cement volumes would impact PAT by 2%. Upside risks that could sustain the shares above our target price include better production discipline, higher price hikes, stronger demand, or lower costs vs. expectations.