With foreign capital inflows booming once more, familiar issues have resurfaced. A bunch of views on how much reserves will RBI accrete, how much will the rupee appreciate and how that will help lower inflation and bond yields, the impact upon exports, growth, etc, have emerged. There is a sense of d?j? vu here. While the common thread across diverse views, viz., reserve-building to insure against financial stability risks, is quite a novelty but entirely explained by last year?s scare, a familiar omission is the role of productivity in exchange rate movements. Should a currency?s strength derive from fundamental gains or should the boom-bust capital flow dynamics continue to be a driver? Let history illuminate the discourse.

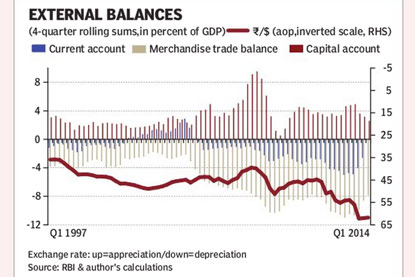

The accompanying chart shows the long-term evolution of external balances and the exchange rate, more than two decades since trade and financial deregulation began. To start with, India has done well with financial globalisation. As share of the GDP, the net capital account lifted from an average 2.3% in late-nineties to about 4.1% over 2004 to present. That reflects easing of financing constraints, lowered cost of funds, besides expanding investment opportunities abroad, amongst other things.

The second is the trend deterioration of the merchandise trade deficit and associated reflection in the current account. From an average -3.5% of the GDP in the late nineties, the goods? trade deficit more than doubled in 2004-08, notwithstanding the robust export growth during the global trade boom; post-crisis, the trade deficit enlarged to -9.2% of the GDP on average. Exports are increasingly unable to service a fast-expanding economic base that doubled from $500 billion in 2003 to $1 trillion in 2007, and then again to $1.9 trillion at present; even in rapid growth episodes, for example, the merchandise trade deficit widened by a factor of five. This indicates a steady loss of manufacturing competitiveness over time. The current account deficit, a broader measure that includes investment income, reflects the rising drain of net income outflows from FDI-associated liabilities that almost trebled over 2009 to present. The broader picture therefore is overturning of the principle underlying the intertemporal dynamics of the current account, i.e., borrow today to expand the productive base that then generates future surpluses to repay past debts.

The third feature is simply the sum of one and two?trend increase in capital account financing of current account deficits. What is not visible here, but is noteworthy nonetheless, is a startling jump in the share of short-term, portfolio capital in overall external financing?from a pre-crisis, under-10%, this rises to nearly two-third share post-crisis?with larger debt-creating component. Given the sudden flight tendencies of such capital, external financing shocks are directly transmitted to the real sector via the exchange rate, the most important price in any economy. Both exchange rate and output volatility are higher because of the capital-current account linkages.

The fourth is, of course, exchange rate fluctuations. Appreciation is inevitably associated with higher capital inflows; not from lasting, fundamental improvements in trade-current account-fiscal balances, inflation, and so on; appreciation episodes are typically followed by sudden, large corrections aligning the exchange rate closer to fundamental, equilibrium values. Post-crisis, the frequency of the exchange rate swings is higher, while a long-term weakening trend of the exchange rate is unmistakable.

The picture that emerges then is of steady erosion in external competitiveness, which limits the benefits from trade liberalisation; financial openness outpacing the former and the increasing size and scale of asset flows resulting in the financial tail wagging the real-economy dog at ever-higher frequencies; and a repetitive, boom-bust cycle that increases overall uncertainty, is disruptive for the real sector, and in the last such event (July-August 2013), pushed the country to the brink of a crisis, even inviting calls to approach the IMF.

Exchange rate appreciation has never originated from productivity increases but from capital flow cycles. High inflation has been one factor eroding cost competitiveness. There are others: the remarkable absence of any structural, supply-side changes to enhance productivity, apart from the first burst of reforms in the early nineties; as the economy has grown, factor market and institutional constraints have rapidly multiplied to undermine the existing advantages too. To this must also be added the effects of an uncompetitive exchange rate in times of real appreciation, particularly adverse for labour-intensive manufacturing where many export products such as textiles operate on low margin-high turnover basis.

As yet another surge in capital flows commences, in a context of no structural rebalancing of the current account or lower inflation, questions about external policy objectives arise in the light of the past. For instance, is capital account financing of the current account the normal, natural thing to do? Should efforts be directed to de-link the current and capital accounts? If so, where and how does the exchange rate fit into the scheme of things? Can productivity-enhancing, structural reforms be the leading source of exchange rate strength? Or should short-term appreciations from surges of foreign capital be perpetuated, helping meet equally temporary macroeconomic objectives? The case rests.

The author is a New Delhi-based macroeconomist