History, it is said, doesn?t repeat itself, but it does rhyme. The waning dominance of national political parties has led to a resurgence of the spirit of federalism?akin to much of modern Indian history where the Indian state was a loose confederation of princely states and provinces. Regional political parties are increasingly demanding and, in most cases, getting a say in matters as diverse as foreign policy (Teesta water-sharing accord with Bangladesh and India?s vote for a US-led resolution in the UN Human Rights Council are cases in point) and national security (states blocking creation of National Counter Terrorism Centre). Nowhere perhaps is the clamour for more federalism greater than in the fiscal arena. States are demanding more financial resources from the Centre and greater autonomy to spend it. A closer examination of government revenue and expenditure data reveals that the Indian political system, at least on the fiscal side, is quite decentralised, much more than commonly perceived.

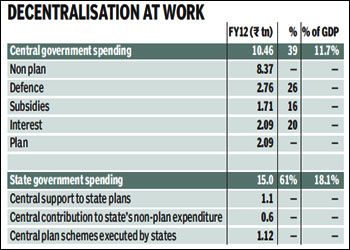

Nowhere is this more apparent than in government expenditure. In FY12, the total government expenditure (Centre plus states) was R25.5 trillion (or 29% of GDP). Contrary to conventional wisdom, the state governments accounted for almost 60% of this expenditure. The total expenditure of all state governments was R13.9 trillion while that of the central government was R10.5 trillion. But this is not what the budgets show because almost 25% of central government ?expenditure? actually consists of transfers to state governments, including R1.05 trillion as central support to state plans, R0.55 trillion as central support to state?s non-plan expenditure and R1.12 trillion transferred for the implementation of centrally sponsored schemes like rural employment (MGNREGA) or rural roads (PMGSY).

Nowhere is this more apparent than in government expenditure. In FY12, the total government expenditure (Centre plus states) was R25.5 trillion (or 29% of GDP). Contrary to conventional wisdom, the state governments accounted for almost 60% of this expenditure. The total expenditure of all state governments was R13.9 trillion while that of the central government was R10.5 trillion. But this is not what the budgets show because almost 25% of central government ?expenditure? actually consists of transfers to state governments, including R1.05 trillion as central support to state plans, R0.55 trillion as central support to state?s non-plan expenditure and R1.12 trillion transferred for the implementation of centrally sponsored schemes like rural employment (MGNREGA) or rural roads (PMGSY).

Decentralisation of government expenditure is the truest expression of federalism. In a country of continental proportions like ours, the principle of federalism rests on the premise that public services should be provided locally while public goods should be dealt with centrally. When governments closest to the people provide most of the public services (education, healthcare, local infrastructure), it allows not only for the expression of variegated preferences among people of different states but also for voters to hold their representatives accountable for the quality of these services. Central government expenditure, on the other hand, is confined to public goods (like defence) or to projects that are not limited to a single state (railways, national highways etc).

India?s federalism is asymmetric?state governments have wide ranging responsibilities (education, healthcare, law and order, justice, agriculture etc) but a limited authority to generate revenues. As such, a part of states? expenditure is financed with transfers from the central government. This is another source of federalists? complaints?states have limited fiscal autonomy as the contours of most state government expenditure are determined by the (extra-constitutional) Planning Commission. While justified, this complaint is often wildly exaggerated. Including states? share in central taxes, central government devolves R5.3 trillion to state governments. Of this, conditional aid?central support to state plans and transfers to implement centrally-sponsored schemes?is only 30-35%. As a result, conditional central aid is about 15% of total state government spending. Of course, given India?s heterogeneity and varied public preferences, there is a case for more autonomy to the state governments. So, for instance, it is better if states?and not bureaucrats in New Delhi?decide whether MGNREGA employment should be suspended during harvesting season or more money should be spent on repairing roads instead of building new ones.

So what explains the increasing clamour for more fiscal federalism? The answer to this, as with many questions, lies in ?following the money??in this case, state finances. It is no accident that the most vocal votaries for fiscal federalism?Mamata Banerjee, Nitish Kumar and, recently, Akhilesh Yadav?rule states that have among the worst fiscal records. Bihar?s fiscal performance stands out as a blemish to the state?s otherwise stellar track record. Bihar?s fiscal deficit in FY12 was 5.5% of GSDP (versus initial budget estimate of 2.93% of GSDP?a slippage even worse than the central government!). Bihar?s FY13 fiscal deficit estimate of 2.87% of GSDP is premised on an incredulous assumption of 24% year-on-year growth in its own tax revenues. On West Bengal?s fiscal management, the less said the better. As far as Uttar Pardesh is concerned, Akhilesh Yadav needs greater central support to finance populist giveaways whose annual cost is estimated to be R110 billion, besides one-time expenditures for loan waivers.

Except Uttar Pradesh, these states have a poor record of generating tax revenues from their own sources (i.e. state excise duty or VAT). Both Bihar and West Bengal?s own tax-GSDP ratio is 5.2%. This cannot entirely be attributed to these states? backwardness. States like Madhya Pradesh (8.7% of GSDP), Chhattisgarh (7.2%), Rajasthan (6.4%) and even Jharkhand (6.6%) have done a much better job of generating taxes from their own sources. Much of the talk of greater fiscal federalism is a ruse by states for a central bailout, so that they can escape politically unpopular decisions of raising revenues or reducing expenditures. There is indeed a need for a debate on how much autonomy states should have in structuring centrally-sponsored schemes or whether there should be so many centrally-sponsored schemes in the first place. But that is a debate only a few ?fiscal federalists? are interested in.

The author is an analyst with BNP Paribas India. Views are personal