Activity unlikely to resume without price adjustments to dispose off unsold stocks

Can the housing market recover without price corrections? That?s a question for policymakers to ask. As realty stocks soar and debt-laden firms ask for interest rate cuts to revive the market, the amazing counterpart is of mounting inventories, declining incomes but rising house prices! One would expect prices to adjust in a downturn when demand falls and excess capacity arises; demand-supply equilibrium is restored in the process, paving the way for transactions to resume. No such mechanism seems to be at work in the Indian property market though, where price corrections have essentially meant some deceleration, but not enough to sell off existing stock. The disconnect between weak growth and house prices suggests there is need for further correction.

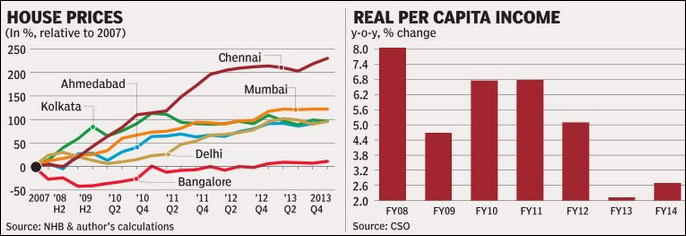

The trajectory of housing prices in six major cities from 2007-2013 is shown in the first of the accompanying charts. House prices have not only grown extraordinarily relative to 2007 levels, but also doubled in a very short span. Prices moderated just a wee bit at end-2013 in some cities, falling in just one, rising in another. House prices were reported to rise up to 7% in 12 major cities, according to the National Housing Bank last week.

Against these housing price trends, per capita income growth is observed to fall very sharply ?from 6.8% in the two years to 2010-11 to 2.1% in 2012-13 and 2.7% last year. The fraction of incomes that consumers can spare for housing, or loan-to-income ratios, are significantly higher. On the affordability metric therefore, if real income growth is stagnating at about 2% for the past two years and isn?t going to jump any higher this year too, can consumers commit to long-term loans of large magnitudes, e.g., a Rs 70 lakh loan for a house priced at R1crore, plus owned funds to meet the standard 30% margin?

The number of transactions?the key link between housing and consumer demand in an economy?is one indicator of the stark disconnect between growth and housing prices. While aggregate data isn?t available, reports show sales have plummeted in the NCR in the past four quarters or so; several firms judge it will take at least another year and a half for things to get any better. A December 2013 survey by Reuters showed that house price increases in major Indian cities are expected to slow to just under 8% in 2014; property prices were sky high in some of the key markets; and developers were holding on to prices, making some locations unaffordable. Data gathered by research firm Prop Equity reported that overall absorption of units and new launches fell by half in the quarter ended March 2014.

Inventories are rising too. According to a Knight Frank research report, existing stock in Mumbai now takes nine quarters, or almost twice the five quarters it took in December 2011 to sell, while new launches fell 40% relative to 2010 peak levels. Another estimate (Liases Foras) shows dramatic rise in unsold inventory levels: in the December 2013 quarter, about 6,50,000 apartments that would take over 30 months to be sold, remained unsold; the number was up to 700,000 by end-March 2014. One major real estate firm reported ready stock worth R4,000 crore, under-construction stock more than three times this amount, and twice the worth of new, pipeline launches.

Compare these trends with the US, for instance, where sharp price falls were painful but contributed in aiding market recovery. Housing prices plunged in the two years after the sub-prime crisis: the Economist index of US house prices (10-city) shows an above-100 point nominal fall from late 2006 to 2009; in real terms, prices fell by over 70 points; relative to average incomes, the index fell from 158 to100 in this two-year span. Activity picked up following these adjustments, which helped the market recovery.

By contrast, we don?t just see abundant supply coexistent with rigidly high prices in India, but the long-term pace of increase is much faster in relation to incomes. That is an indication of overvaluation. The Reuters survey assigned a property rating value score of 9 in Mumbai and Delhi on a 10-point scale (1=extremely undervalued, 10-highly overvalued), compared to London?s score of 6, where there is a well-acknowledged property boom inviting concern from policymakers.

From all dimensions, it would appear housing prices need further corrections in India. The property market is a major test of how successful an economic turnaround is, given its extensive forward and backward linkages. The lengthier the stretch of this adjustment process, the longer it takes for economic activity to return. To be sure, a fall in property values is not painless; wealth effects from appreciating house values have been significant in recent years, indicating the dependence upon real estate relative to other assets. But given the weak sales and revenue growth that directly impact operating cash flows of major debt-stressed real estate companies, the sitting stocks must be nudged to be sold. Anomalies such as these are unsustainable for long periods and can take an ugly turn, as the property market wobbles in China seem to be showing. Price adjustments to the ebb and flow of demand for housing, on the other hand, will encourage genuine buyers, discourage speculators and pave the way for a healthy recovery.

The author is a New Delhi-based macroeconomist