The Reserve Bank of India (RBI), in its monetary policy review on October 30, maintained the repo rate at 8%. Despite revising its 2012-13 GDP growth forecast downwards to 5.8% from 6.5% projected in July, the central bank refrained from reducing rates as inflation remains above 7.5%. This persistence in inflation, based on the wholesale price index (WPI), can partly be explained by sustained pressure on food prices and hikes in administered fuel prices. What is disconcerting, though, is that even non-food manufacturing inflation (core inflation), which indicates underlying demand-side pressures in the economy, continued to be high at 5.6% in September.

Non-food manufacturing inflation, which is obtained by excluding food and fuel from the overall price index, is not directly influenced by supply-side shocks, such as weak monsoons, high global crude oil prices or administered fuel price hikes. Therefore, RBI uses it as a proxy for measuring domestic demand-side pressures on inflation. Why is non-food manufacturing inflation rising, when demand growth, as reflected in GDP growth, is weakening? International evidence suggests this inconsistency can be attributed to a combination of two factors. First, core inflation tends to follow movements in economic growth with a lag. Second, one-time cost increases such as currency movements, changes in tax structure and administrative price hikes can distort core inflation movements.

Non-food manufacturing inflation, which is obtained by excluding food and fuel from the overall price index, is not directly influenced by supply-side shocks, such as weak monsoons, high global crude oil prices or administered fuel price hikes. Therefore, RBI uses it as a proxy for measuring domestic demand-side pressures on inflation. Why is non-food manufacturing inflation rising, when demand growth, as reflected in GDP growth, is weakening? International evidence suggests this inconsistency can be attributed to a combination of two factors. First, core inflation tends to follow movements in economic growth with a lag. Second, one-time cost increases such as currency movements, changes in tax structure and administrative price hikes can distort core inflation movements.

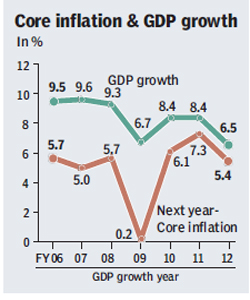

As frequent price revisions involve administrative and other costs, firms change prices only after carefully evaluating demand trends and potential reactions of their competitors and customers. As a result, prices tend to be slow to adjust to changes in demand and core inflation follows growth cycles with a lag. In India, the lag between changes in GDP growth and core inflation has historically been around one year (see chart). For example, as GDP growth slowed to 6.7% in 2008-09, core inflation fell sharply in the following year. The sharp decline in core inflation in 2009-10 can be seen even if one excludes prices of basic metals, which collapsed completely during the global financial crisis. In 2009-10, the CRISIL Core Inflation Indicator (CCII), which does not include prices of basic metals, fell to 4.2% from 5.2% in the previous year. Subsequently, as government stimulus lifted growth to 8.4% in 2009-10, core inflation surged back to over 6%.

This one-year lag indicates that average core inflation this fiscal would be much lower than in 2011-12. This is because GDP growth fell to 6.5% last year from 8.4% in 2010-11. Indeed, the average core inflation in the first half of 2012-13 has been lower vis-?-vis last year. Recent monthly data, however, suggests a reversal of the declining trend in core inflation, which has risen to 5.6% in September from 5.1% in April.

Does this indicate that demand-side pressures are rising even though economic growth has decelerated to below its current potential, as per the RBI judgement of around 7-7.5%? Perhaps not.

The above aberration may be the outcome of a partial pass-through of one-time shocks to production costs of firms. Such shocks include the sustained weakness in the rupee, which has raised the prices of imported inputs and the electricity price revision earlier this year, which has permanently increased the operating costs of firms. The extent and speed at which cost increases are passed onto consumers depend on factors such as demand conditions, the cost of adjusting prices, magnitude of these cost-related shocks, and producers? expectations of whether these shocks are temporary or permanent. For example, if the cost increase is deemed permanent, as in the case of electricity price revisions, producers will try to pass it on, at least partially, to protect profit margins. The extent of pass-through, however, is usually lower if demand conditions are weak.

For example, prolonged weakness in the rupee for several months would have adversely impacted corporate profit margins in industries such as chemicals and basic metals where the imported input cost is high. These are also the industries where inflation is above 7%, possibly due to a partial pass-through of these costs, raising their contribution in WPI core inflation to almost 60% in September 2012.

Such cost-push pressures do not tend to have a sustained impact on inflation, if demand growth continues to remain muted. In an environment of slowing demand, the probability of a wage price spiral is lower?despite current high inflation, employees are less likely to witness wage hikes as corporate profitability is already under pressure from weak demand. While rural wage growth remains high, it has moderated to 18% in August 2012 from a peak of 22% a year earlier. With GDP growth slowing down sharply over the last few quarters, further moderation in rural wage growth cannot be ruled out in coming months. With probability of an all-round wage hike remaining low, core inflation could begin to decline over the coming months.

What does this imply for the monetary policy? As monetary policy transmission has a lagged impact on inflation, central banks tend to be forward-looking and factor in the expected changes in core inflation, rather than respond to temporary cost-push pressures. Keeping this in mind, RBI has hinted at a further loosening of monetary policy, perhaps a rate cut in early 2013. Nonetheless, while core inflation could moderate in the coming months, high food and fuel inflation will keep WPI inflation well above RBI?s stated tolerance limit of 4.5-5% for the foreseeable future. This will still make it difficult for RBI to communicate the rationale behind a repo rate cut, as and when it is done.

‘Vidya Mahambare is principal economist and Neha Duggar Saraf is junior economist, CRISIL’