There is some traction on investments via CCI and fiscal consolidation through cash transfers and tax reforms

In this article, we discuss the hopes and risks in the Indian macro landscape of 2013, spanning both economics and politics. Our base case is that the worst is over with expectation of some traction on both investments (via Cabinet Committee on Investment) and fiscal policy (cash transfers, tax reform).

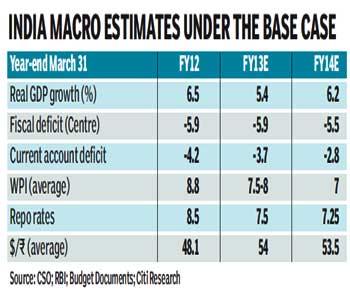

Our base case assumes (1) a relatively benign global environment growing at 2.6%; (2) steps towards reversing the decline in investments; (3) measures on the fiscal?particularly a move towards cash transfers and a gradual implementation of tax reforms; (4) stable/lower commodity prices; (5) continuation of measures to attract capital flows; and (6) no early elections.

Our base case assumes (1) a relatively benign global environment growing at 2.6%; (2) steps towards reversing the decline in investments; (3) measures on the fiscal?particularly a move towards cash transfers and a gradual implementation of tax reforms; (4) stable/lower commodity prices; (5) continuation of measures to attract capital flows; and (6) no early elections.

However, there are risks as well as opportunities. The four key risks are global, political, housing and ratings, while the four key opportunities are growth, inflation, fiscal and savings & investments.

Four key risks:

Global dynamics: Following a 2.5% growth in 2012, Citi?s base case is for global growth of 2.6% in 2013E and 3.1% in 2014E. Evolving dynamics in 2013 include the US fiscal cliff, euro area uncertainty, Middle East geopolitics, and also China issues?all of which will play their role as India?s dependence on global capital and risk appetite remains high.

Politics: Reigniting interest with the first phase of reforms in September (fuel prices, FDI and divestments), the government has fuelled hopes that this is not a false dawn. Despite the political cost, the government has stepped up the momentum and announced several measures (FDI in insurance, pension, SEB restructuring, raising urea prices, and reducing withholding tax rates). Encouragingly, the government has also taken steps to address structural issues on the fisc and incentivising investments?both of which are key to avert a ratings downgrade and accelerate growth. However, while the measures have broken the two-year policy logjam, key to note is that many of them require parliamentary approval to be implemented. Moreover, given the upcoming state elections and the big one in 2014, the window is relatively small.

Interestingly, recent investor feedback on politics was that similar to the US, Europe and China; politics in India is now just ?another variable? in the investment landscape. But there are differing views on the impact, with one camp of the view that the market was currently pricing all to perfection, and the other that the rally could persist if the government delivers even 50% of what?s promised.

Real estate: Despite falling absorption rates in both residential and commercial space, property prices continue to defy gravity and edge up through all-time highs. This is resulting in inventory build-ups with the latest data indicating that residential absorption in key cities of India has declined by about 16% yoy in 1HFY13 while commercial absorption has come off 29% in 1HFY13.

Given the current dynamics, reflected in the fact that there is pent up demand with most buyers in India being end-users and LTV as mandated by RBI is low at about 80%, the India property sector is far from a bubble, but clearly needs a watch. However, a continuation of inventory build up could eventually result in a slowdown in construction activity, thus impacting GDP; and a rise in stressed assets from building companies.

Ratings: Earlier this year, both S&P and Fitch revised India?s sovereign outlook from Stable to Negative?reiterating a one-third likelihood of a downgrade in 24 months if political, economic, fiscal or external factors deteriorate. While Moody?s has retained India?s outlook at Stable, it has stressed that failure to narrow deficits could endanger India?s credit strengths and has said that the Stable outlook is predicated on some policy efforts to curtail the deficits.

We maintain our view that the recent reforms have ?bought? India time to avoid a downgrade, but that implementation and fiscal consolidation measures are key. It is important to note that while the real economy is largely domestic-oriented, given its dependence on capital flows, India is a high beta economy in terms of global risk appetite. Last but not the least is the implication of a ratings downgrade. Unlike the past, given the growing reliance of the private sector on external sources of funding, negative rating action would increase the cost of borrowing for India Inc.

Four key opportunities:

Growth: In addition to implementation of the Cabinet Committee on Investment, which will have a marginal delta positive impact on project implementation, key areas for upside would be revival in road investments (5,000 km awarded in FY11-12 dropped to 600 km this year) and Railways. Investments from cash-rich PSUs may also get a nudge based on comments from the FM suggesting they need to invest or start paying out more dividends.

Inflation: Given the benign commodity price outlook for 2013?a combination of new supply surplus not just in natural gas but also critical industrial and bulk commodities?and structural shifts in China are forcing a revaluation of commodity demand. This bodes well for WPI inflation in India, given that tradables account for about 57% of the WPI in India. Interestingly, during our recent marketing trip, investors felt that inflation/rates could surprise positively in 2013. This was on the back of stable commodity prices and the INR given the high weightage of tradables. We have currently priced in 75 bps of easing by end-FY14.

Fiscal: Expenditures/deficits tend to rise in a pre-election year. While we do expect to see welfare schemes getting a boost, what could offset it would be moves towards both cash transfers and GST. We really believe the move towards direct cash transfers can be a major structural shift in India?s deficit. The biometric ID scheme continues to make progress and should start to put an end to the massive ?leakages? and excess spending as a result of the current system. In addition, hopes that GST could finally materialise would also be a significant boost on the fiscal.

Savings and investments: These have been in decline since 2008. Lowering inflation expectations and fiscal consolidation could lead to a welcome reversal in this trend.

The bottom line is that 2013 is a crucial year?both economically and politically. There are plenty of shifting dynamics: (1) the macro should improve at the margin; (2) politics will tend to be more dominant but could swing either way; (3) policy execution would play a key role in economic outcomes; and (4) the global influence will remain on the currency?risk appetite and oil prices are key.

The author is chief economist at Citi India