n Physical buying shores up global prices by 2% after Monday?s mayhem; investors cautiously optimistic on future direction

Domestic consumers scrambled to buy gold on Tuesday to take advantage of a recent drop in prices, reflecting underlying demand for the precious metal ahead of the wedding season next month. Jewellers say an about 10% drop in prices since Friday has driven up sales by 15-20% while gold loan providers rule out any significant risk to business as they always factor in some fluctuations.

Domestic prices crashed after gold hit a two-year trough on Monday in overseas markets, which have now dropped more than 10% in the last two sessions, reviving demand in India and China, the world’s top buyers of bullion. Gold prices have lost close to 26% since hitting the record level of $1,920.30 an ounce in September 2011, attracting buyers and sending premiums for gold bars to a 16-month high in Asia.

Consequnetly, spot gold prices overseas rose more than 2% to around $1,390 an ounce in intraday trade after crashing 8% on Monday. The precious metal hit $1,321.35 an ounce earlier on Tuesday ?its lowest since January 2011?before a surge in physical buying due to the price fall helped reverse the slide.

“The correction in gold prices is positive news for domestic retailers and manufacturers as it makes jewellery more affordable for consumers. More enquiries from customers have been witnessed in the last 3-4 days and more sales have taken place,” Sanjeev Agarwal, chief executive at Gitanjali Export Corporation, told FE. “If prices remain around this level, demand will go up. Plus, there are times in a year, including Akshya tritiya, Dhanteras, Diwali and the wedding seasons, when domestic demand goes up despite a rise in gold prices. So, the long-term propects of Indian demand remain robust,” he added.

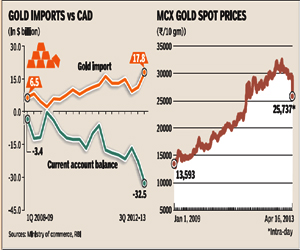

Jewellery makes up for around 65% of India’s and 43% of global gold demand. Any sharp fall in prices could revive seasonal demand in India, which usually plays a key role in driving global demand but has been hit this year by a depreciation of the rupee and an effective six-fold rise in the import duty to 6% in around a year. Consequently, India’s gold imports have dropped 24% in the last quarter of 2012-13, which will provide some comfort to policymakers troubled by a runaway current account deficit.

Agarwal said all the major jewellers have fully hedged gold, and price fluctuations of any type don’t hurt their businesses. “Although some small jewellers don’t usually hedge, the recent price drop won’t hurt them much. This is because such jewellers have been in this business for generations now, and they must have bought gold even at much lower prices before. So the effective losses due to the recent fluctuation may be very minimal for them,” he said.

However, despite the recent drop in prices, some buyers are deferring purchases. “The fall in prices has renewed demand in gold jewelery… However, expectations of a further fall in prices have kept some gold buyers at bay,” said Suvanker Sen, executive director with Senco Gold, the largest jeweller in eastern India.

“If the rupee remains weak, gold prices are unlikely to fall further. However, a strengthening of the rupee will see gold fall further and it could go to R27,200 per 10 gram level, and internationally the precious metal could be in the $1,400 per ounce level by the end of this month,” he said. Falling for the third straight session, gold on Tuesday crashed by a whopping R1,160 to R26,440 per 10 grams in New Delhi. However, small jewellers are cautious in adding to their inventories, fearing a further drop in gold prices.

Companies that provide loans against gold said the drop won’t hurt them much. “Around 15-20% price fluctuation in gold prices is already factored in our business model. Though gold price is an important factor, the business model should not be misunderstood as a business of financing of bullion or shares where mark to market could affect the repayment behavior. Since we are financing only household jewellery, the impact of such fluctuations is minimal,” said George Alexander Muthoot, MD, Muthoot Finance.

Bargain hunting lifted premiums in Hong Kong to $2 an ounce and spot London prices rose from $1.60 to $1.70 last week as purchases rose while Japanese buyers outnumbered sellers as consumers also fretted about the new economic policies of Prime Minister Shinzo Abe, according to Reuters. The premium for Japanese gold bars strengthened to as high as $1 from flat to discount last week, and there was also buying interest related to tensions on the Korean peninsula. Physical dealers in Singapore, who sell gold to India, pushed up premiums for gold bars to their highest since October 2011 to offset the fall in cash prices.

However, the market is overshadowed by apprehensions of central bank sales and global growth, which have prompted investors to dump their holdings. Vast outflows on global gold exchange-traded funds, which trimmed holdings to their lowest in more than a year, may also mark the end of a love affair between gold and investors.

“The slump in gold prices seems to be taking a halt as is has broken all near-term supports and had a free fall over the last two trading sessions. The next big support for gold exists at $1,310 an ounce and we expect that support to hold for the near term. A pullback towards $1,400 looks possible and holding above that can extend it towards $1,440 also,” said Kishore Narne, head of commodity and currency at Motilal Oswal Commodity Broker .

Metals gain after Monday chaos

Copper and silver rebounded, although brent crude oil still remained below the $100 per barrel level. Silver and palladium gained nearly 4% each while platinum increased around 2%. Copper on the London Metal Exchange gained about 1% to $7,274 a tonne on expectations that the outlook for growth and demand from top consumer China would improve in coming months.