P Chidambaram received accolades from some unwary quarters for having brought down the fiscal deficit by 1.2% of the GDP over the last two years. Pranab Mukherjee had allowed it to climb to 5.7% in 2011-12. Chidambaram declared victory by showing that the fiscal deficit had been brought down to 4.5% in 2013-14 (FY14) that was significantly lower than the target of 4.8%. This was sheer miracle. The sharp reduction was apparently achieved despite lower than targeted GDP growth, sharply lower tax revenues, weak disinvestment receipts and subsidy payments. However, Chidambaram did manage to avert a credit downgrade with this show of fiscal rectitude. But was it for real?

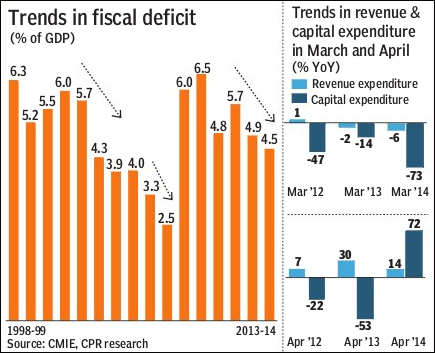

Since 2000, there had been three periods when fiscal deficit was brought down by more than 1% over two years (see chart 1). In FY04, fiscal deficit was reduced by 1.7% aided by definitional change. And in FY08, it was brought down by 1.4% over FY06. So Chidambaram?s effort, if for real, deserved kudos.

With fiscal deficit officially reported to be 5.3% for the 11 months until February, the entire fiscal improvement was apparently achieved in the single month of March 2014.

Moreover, as the latest data reveals, there has been a 72% year-on-year increase in capital expenditure in April 2014 and 70% increase in non-Plan expenditure in May. This has pushed up total expenditure in first two months of FY15 to 29% year-on-year versus budgeted estimate of 12.8% and the fiscal deficit in these two months to 45.6% of budgeted estimate as opposed to 33% in the previous year. Prima facie, therefore, this calls for a more detailed examination.

Provisional estimates for FY14 indicate that gross tax revenues, growing only by 10% against a target of 19%, fell short of budgeted numbers by about R97,000 crore. This reflected the impact of the sub-5% GDP growth rate for last eight consecutive quarters. The lower industrial and foreign trade growth resulted in a shortfall of about R43,000 crore in excise and custom duties. And service tax collection came in lower by R25,500 crore despite the inclusion of several new services in the tax net. Disinvestment receipts were even less than half of the budgeted amount on poor market sentiments. Non-Plan revenue expenditure was higher by R30,000 crore mostly due to increased subsidy payments. But despite the shortfall in tax and capital revenues and higher subsidy payments, the previous government managed the impossible and brought fiscal deficit down to 4.5%!

The impossible was achieved essentially by bringing forward the revenue receipts, shelving some expenditures to the next fiscal year and making unsustainable cuts in capital expenditures. First, the government forced the cash-rich PSUs to pay special dividends totalling R43,075 crore in FY14, which is more than three times (322%) R13,354 crore in FY13. The National Mineral Development Corporation (NMDC) in February 2014 announced an interim dividend of 550%, taking the pay-out in that fiscal to 850%, and depleting its reserves by close to R3,400 crore. This raid on PSU reserves by Chidambaram is completely unsustainable.

Second, the central government sharply cut down the expenditure to bridge the revenue shortfall. The Plan expenditure was axed by R1 lakh crore from the budgeted estimate.

l Expenditure cuts were particularly harsh in the last quarter of FY14. Rather than any increase over the previous year, total public expenditure in Q4 of FY14 declined by 24% year-on-year, of which capital expenditures fell by a huge 34%. Effectively, the government was sacrificing growth to maintain transfer and subsidy payments?a sure recipe for stagflation.

l Part of the expenditure in March 2014 was rolled over to the next fiscal. In March 2014, the total expenditure declined by 14% year-on-year on top of a decline of 3.3% in March 2013. As seen in the accompanying charts, capital expenditures declined by a whopping 73% year-on-year in March 2014. Just to prove the point, capital expenditures in April 2014 jumped by 72%! Surely, these had simply been pushed back far more than in previous years.

l Correspondingly, spending in March 2014 was merely 1.44% of GDP as against an average of 2.36% over the last several years. Only 20% of total estimated expenditure was spent in the last quarter, which is much lower than the 33% allowed by the cash management system of the central government.

Third, it is reported that R1 lakh crore of subsidy (for food, fuel and fertiliser) has been rolled over to the next fiscal. The government announced that R35,000 crore of oil subsidy would be rolled over to FY15, which is claimed as the payment for Q4 FY14. This means only R40,480 crore was paid as oil subsidy for three quarters of FY14. Common sense tells us that much more than the Q4 oil subsidy, as is the practice, is being pushed back to FY15. The roll-over of unpaid subsidies and bills, admittedly standard practice, seems very large when compared to previous years. Thus, we can easily arrive at a conservative estimate that around R50,000-70,000 crore of expenditure has been pushed back from FY14 to this fiscal.

The new finance minister, who is in an unenviable position, could use the option of the modified cash basis accounting that ?allows a short period of time after the year-end for settling liabilities of the year just ended (and treats this expenditure as occurring in the previous year).? This will allow the deferred bills of FY14 that were paid in April and May 2014 to be included in deficit calculations for FY14. This will result in the fiscal deficit for FY14 coming in at 4.8-5% of GDP instead of 4.5% as claimed in the interim Budget. This will help the government to start with a clean slate and help improve the credibility of government estimates. This will surely stand Arun Jaitley in good stead in the coming period. However, so as not to spook the markets and investors, Jaitley will have to supplement this cleaning up of fiscal accounts by announcing a set of bold, transparent and feasible measures to restore the growth momentum and maintain fiscal discipline.

(This is first of a two-part series)

Rajiv Kumar is senior fellow and Geetima Das Krishna is senior researcher at the Centre for Policy Research, New Delhi