Falling gold prices may restore some investor interest in equities. For the second consecutive year, domestic gold prices are expected to underperform equities, thanks to muted global prices, an appreciating rupee and government curbs on gold imports.

Market experts, therefore, expect equities to regain some of the shine as an investment avenue they had lost to the precious metal during the last five years.

Market experts, therefore, expect equities to regain some of the shine as an investment avenue they had lost to the precious metal during the last five years.

Following more than $29 billion of foreign institutional flows since 2012 ? even as Indian benchmark indices trade near two-year highs ? domestic investors have largely opted out, given the sustained outflow from equity mutual funds and continuous selling by the domestic institutions, of the order of $14.6billion, during the period.

This scenario is likely to improve this year, believe some experts, as retail investors may get convinced of the scope of equities. ?Unlike 2012, we are not likely to see huge exits of domestic investors this year. In fact, in the next 6-9 months, some interest may come back as investors align their portfolios with some liquidations of exposure in assets like gold and real estate,? said Nirak Kumar, head of equity investments, Aviva Life Insurance.

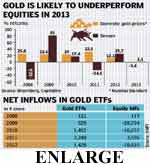

Domestic gold prices have have given positive returns each year since 2000 even as annual returns on Sensex turned negative in both 2008 and 2011. In 2012, Sensex outdid gold by close to 14%.

Even in 2013 so far, the benchmark indices have gained close to 1.5%, whereas spot gold prices have dipped by a similar extent.

During the last two years, a sharp rupee depreciation of about 20% added to the increase in domestic gold prices even as international prices traded 12% below their all-time high of $1,900 per ounce, touched in November 2011. Not surprisingly, even the investor purchases of gold exchange-traded products have largely beaten the net inflow in the equity mutual funds excluding 2011. Market observers argue that even as the strong allocation to gold from hedging perspective may continue, from capital gain or return perspective, the investor orientation is likely to come off.

?The tendency to buy gold for investment has come down considerably among the high-income groups as equities are considered fairly valued just as demand for fixed-income products have remained robust,? said Raghvendra Nath, MD, Ladderup Wealth Management.

The craving for gold as a safe-haven asset is expected to come down this year amid a stabilising economic scenario in developed nations, including the US and European region. The quantitative easing measures of the global central banks are seen lending support to gold’s demand as an inflation hedge. However, a likely shift in institutional investors’ gold exposure that currently stands at record highs could also set in huge price correction.

According to Barclays Capital, which pegs the gold held across physically backed exchange-traded products at 2,649 tonne, such huge holdings pose a key risk to prices.

?Gold prices risk a 5% correction from the current levels also as rising FII inflows in India amid falling risk aversion could lead to further rupee appreciation,? said Anil Rego, CEO, Right Horizons Wealth Management.

However, Maneesh Dangi, Co-CIO, Birla Sun Life AMC, says gold buying among Indians is a function of the absence of ‘financialisation’ of savings as the banking and financial products still have comparatively low penetration. ?While there has been a broader shift away from financial assets to physical assets like gold and realty in the last two-and-a-half years, it may take about 3-5 years for this trend to reverse,? said Dangi.