At a conference call for analysts on Friday, Docomo NTT?s president Kaoru Kato said the company took the decision to exit its Indian JV at the end of five years, which allowed it to exit with a minimum return of 50% of the acquisition price. Kato added that given the uncertainties of the telecom market in India, it was a difficult choice for the company to carry on operations.

?The spectrum administration in India was confusing. The licence that we have was repelled, and our spectrum was taken away. And also, in addition to that, we have to pay spectrum utilization charges on top of the licence fee. In India, spectrum is awarded on a circle-by-circle basis. So, in the highest traffic circle of New Delhi, we pay for spectrum, but we haven’t been able to receive the spectrum yet,? he said adding, even ?Tata is struggling today in making a profitable business.?

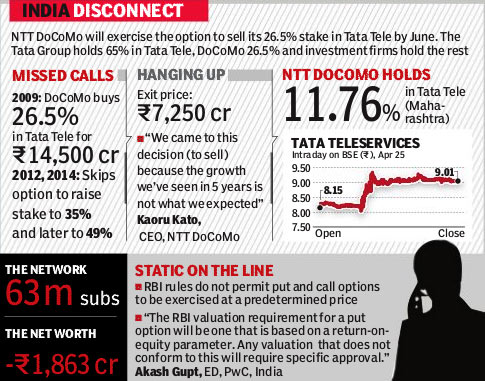

TTSL and Docomo have agreed the Japanese company holds the right to ensure that its TTSL shares be acquired for 50% of the acquisition price, which amounts to Rs 7,250 crore (or 125.4 billion yen) or a fair market price, whichever is higher, in the event that TTSL fails to achieve certain specified performance targets (the above-mentioned option), the Docomo release said. Docomo specified neither the buyer nor the value of the deal.

?Docomo expects to sell its TTSL shares in accordance with the agreement. It is uncertain how the option will be performed, however, and Docomo is not able to predict how events will unfold. The effect on Docomo?s corporate earnings for the fiscal ending March 31, 2015 cannot be forecast at this time due to these uncertainties,? it added.

Analysts believe that given the complications, a third player such as Vodafone may be roped in.

?In the past Vodafone has shown interest and could end up buying Docomo?s stake if the valuation is agreeable to them. Also, players like MTS and Telenor which have limited presence are looking for consolidation opportunities, so they would also want their hands in the pie provided the valuation is fair,? said Shobhit Khare, VP-Research at Motilal Oswal. ?The valuation has eroded since 2009 as market growth has come down,? Khare added.