Despite impressive growth claims by banks ever since RBI pushed for financial inclusion, reality seems different

From a narrow priority sector push to a more encompassing financial inclusion target, Indian banks have covered miles in increasing their penetration over four decades following Independence.

From a narrow priority sector push to a more encompassing financial inclusion target, Indian banks have covered miles in increasing their penetration over four decades following Independence.

While priority sector lending was forced on the banks by the Reserve Bank of India to push farm credit, financial inclusion has shown the viability in catering to the rural customers of banks.

Financial inclusion has become the buzzword for Indian banks ever since RBI urged them to adopt business models and come up with products that would suit poor in 2005.

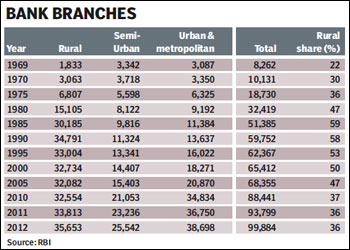

If key data are anything to go by, banks have been successful in increasing their presence. Currently, bank credit encompases 55% of GDP from a mere 5% in 1970s and there are six branches for every one lakh people. Penetration of automated teller machines (ATMs) are also on the rise.

Banks have covered more than 74,000 villages in the last two years and over 36% of total bank branches are in rural areas. Between March 2010 and 2012, over 5 crore basic savings accounts have been opened to enable the poor to save more in banks.

In last ten years, RBI has relaxed norms on branch licences, know-your-customer, has told banks to launch simpler products such as no-frill accounts and has introduced ?branchless? banking through the business correpondent model to aid financial inclusion.

Given the low penetration of bank branches and banks? reluctance to open branches citing high costs and low returns, RBI came up with the business correspondent (BC) model in 2006. By employing a BC, the banks are able to reach out to rural customers without actually building up a branch.

This model has been successful and banks have engaged more than 90,000 BCs so far. Initially, only individuals were allowed to work as BCs for banks. Later, RBI relaxed the norm for BC model further.

However, the success of the BC model ultimately depends on the bank branch network as the BC depends on the nearest bank branch for cash management and documentation, thereby making it imperative for banks to open more rural branches.

In April 2011, RBI mandated that banks will have to open 25% of new branches proposed to be open in a year in unbanked rural areas.

In 2011, the central bank asked banks to develop a roadmap for financial inclusion and get a board approved plan for the same.

Banks were given around 73,000 villages to adopt among themselves and give access to banking to these villages through either branchless model or through branches.

However, despite the impressive numbers stacked up by banks ever since RBI pushed financial inclusion, the extent of financial exclusion is staggering.

As KC Chakrabarty, the deputy governor of RBI and in-charge of financial inclusion, noted in a recent speech,?Even where bank accounts are claimed to have been opened, verification has shown these accounts are dormant. Few people conduct any banking transactions and even fewer receive any credit.? Even now, not more than 40% of the population have access to bank accounts. Despite increase in banks? presence in rural areas, more than half of the 6,00,000-odd villages across the country do not have access to banking.

The share of rural branches has fallen over the years from a high of 59% in 1985 to 36% now indicating that banks are slow in going rural.

Nevertheless, where banks have not been able to reach or are reluctant to do so, other institutions such as micro-finance institutes have set shop.

While RBI supports a bank-led financial inclusion, it has acknowledged the important role micro finance companies play in making credit reach the poor.

However, with MFIs being clamped down by legislation following their controversial recovery mechanism, the onus of financial inclusion has again come on banks.

Given the extent of unbanked areas in the country, financial inclusion still remains an incomplete task. It remains to be seen whether the current decade will achieve RBI?s goal of every Indian having a bank account.