One would have expected India?s top investment bankers to head out to Brazil to watch Cristiano Ronaldo and Lionel Messi in action at what has to be the go to event of the decade. But many of them have decided to stay back and sweat it out in Mumbai for fear of losing out on fund-raising mandates. After a long drought, India?s capital markets look like they?re going to be inundated with equity issuances this year and these are likely to be of all hues ? qualified institutional placements, rights and follow-ons. Companies are rushing to cash in on the appetite of foreign institutional investors (FII) who have so far pumped in close to $9 billion into Indian stocks since the start of 2014; of this, May alone saw close to $3 billion flow in.

?We could see issuances of around Rs 40,000-50,000 crore this year from companies,? said Rashesh Shah, founder, Edelweiss Group, who believes that the inflows of funds into the stock markets this year could be as high as R2 lakh crore. ?If LIC invests close to Rs 50,000-60,000 crore and FIIs bring in some $15 billion or around R1 lakh crore, that alone is R1.5 lakh crore,? Shah observed.

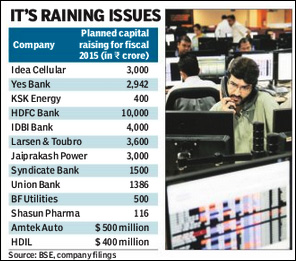

Larsen & Toubro (L&T) said on Tuesday it would be looking for shareholders? to approve a Rs 3,600-crore placement to institutional investors; the engineering firm?s stock hit a lifetime high of Rs 1,774.7 on Monday.

Last month, private sector lender HDFC Bank said it would ask shareholders to okay a proposal to pick up R10,000 crore; the lender?s stock price is ruling close to its all-time high of Rs 854.

Last week, the KM Birla-promoted Idea Cellular mopped up Rs 3,000 crore through a QIP at a price of R134 per share, leaving investors only a 3% discount. On Tuesday, market regulator Securities and Exchange Board of India okayed Indian Hotels Company?s proposal to raise up to Rs 1,000 crore through a rights issue.

In FY14, close to Rs 15,180 was raised via equity, almost half the previous year?s Rs 26,260 crore, according to Prime Database.

?Sentiment has improved, investor confidence is back and companies are not about to let this opportunity to raise equity go by,? said an investment banker with a foreign bank.

Conceding that valuations for a host of overleveraged companies do look stretched, he said investors were playing for a two-year time period. Last week Yes Bank’s QIP sailed through and was oversubscribed by close to five times with the aggregate demand coming in at close to $2.5 billion.

The lender issued 5.35 crore shares at Rs 550 a share, at a slight premium to the previous day?s close and not far from the stock?s lifetime high of Rs 599, hit on May 16.