Varroc IPO: The IPO (Initial Public Offering) of the Aurangabad-headquartered auto component maker Varroc Engineering Ltd has opened today, 26 June 2018, for subscription with a target to raise up to Rs 1,955 crore. Varroc Engineering IPO is the biggest IPO in FY19 so far.

Varroc Engineering IPO is a complete offer for sale from the existing promoters and investors. Varroc Engineering has expected to raise up to Rs 1,955 crore at the upper end of the price band.

Varroc IPO: 19 facts you should know before subscribing to Rs 1,950 crore issue

- In Varroc IPO, the existing promoters and investors will be selling 2.02 crore equity shares of face value of Re 1 per equity share via the offer for sale route.

- Varroc Engineering has fixed a price band of Rs 965 to Rs 967 and has expected to garner Rs 1,955.44 crore at the upper end of the price band.

- In Varroc IPO, investors can bid for a minimum of 15 equity shares and in multiples of 15 equity shares thereafter.

- Varroc IPO will remain open for three days starting today, 26 June, till Wednesday, 28 June 2018. Post-IPO modification period will be held from 10 am to 1 pm on 29 June 2018.

- Varroc Engineering has offered a discount of Rs 48 per equity share for eligible employees category.

- In Varroc IPO, Tarang Jain (17.52 lakh equity shares), Omega TC Holdings Pte Ltd (153.73 lakh equity shares) and Tata Capital Financial Services Ltd (14.1 lakh equity shares) are the selling shareholders.

- In Varroc IPO, 5% of the shares allocated to QIB (Qualified Institutional Buyers) category (excluding the anchor investor portion) shall be available for allocation to mutual funds only, on a proportionate basis, subject to valid Bids being received at or above the offer price.

Also Read | Varroc Engineering Rs 1,955 crore IPO opens today: Should you subscribe?

- “Unless the employee reservation portion is undersubscribed, the value of allocation to an eligible employee shall not exceed Rs 2 lakh. In the event of under subscription in the employee reservation portion, the unsubscribed portion may be allocated, on a proportionate basis, to eligible employees for value exceeding Rs 2 lakh up to Rs 5 lakh. Any unsubscribed portion remaining in the employee reservation portion shall be added to the net offer to the public,” Varroc Engineering said in DRHP.

- The P/E (Price/Earnings) ratio based on the diluted EPS (Earning Per Share) on a restated consolidated basis for the financial year 2017-2018 for Varroc Engineering shares at the upper end of the price band is 28.95.

- Notably, the average industry peer group P/E ratio is 42.6 while the industry heavyweight and the market capitalisation leader Motherson Sumi Systems has a P/E ratio of 41.94.

- Naresh Chandra is chairman and non-executive director, Tarang Jain is Managing Director, Ashwani Maheshwari is Whole-time Director, Padmanabh Sinha is Investor Nominee Director, Gautam P. Khandelwal, Vijaya Sampath, Marc Szulewicz and Vinish Kathuria are the independent directors of Varroc Engineering Ltd.

- Varroc IPO does not contain a fresh issue of equity shares and is a complete offer for sale. Varroc Engineering will not receive any proceeds from the offer and all the proceeds will be received by the selling shareholders, in proportion to the equity shares offered by the respective selling shareholders as part of the offer.

- Varroc Engineering is a global tier-1 automotive component maker which designs, manufactures and supplies exterior lighting systems, plastic and polymer components, electricals-electronics components, and precision metallic components to the passenger cars, commercial vehicle, two-wheeler, three-wheeler and the off-highway vehicle directly worldwide.

- Varroc Engineering Ltd has appointed Kotak Mahindra Capital Company Ltd, Citigroup Global Markets India Pvt Ltd and Credit Suisse Securities (India) Pvt Ltd as the global co-ordinators and book running lead managers while IIFL Holdings Ltd is book running lead manager.

- As at 31 March 2018, Varroc Engineering Ltd held Rs 68,52.39 crore worth of assets. For the financial year 2017-2018, Varroc Engineering Ltd earned a revenue of Rs 10,417 crore and posted a net profit of Rs 451 crore (approx).

- Kotak Securities Ltd and IIFL Securities Ltd are the syndicate members to Varroc IPO whereas Link Intime India Pvt Ltd is the registrar to the issue.

- Notably, Price Waterhouse & Co Chartered Accountants LLP is the auditor of Varroc Engineering Ltd.

- Corporation Bank, IDBI Bank, Citibank N.A, ICICI Bank, Standard Chartered Bank, HDFC Bank (corporate banking), Kotak Mahindra Bank and Saraswat Co-operative Bank are the bankers to Varroc Engineering Ltd.

- Varroc Engineering was incorporated on 11 May 1988 at Mumbai as Varroc Engineering Pvt Ltd. The name company has been changed to a couple of times from Pvt Ltd to Public Ltd. Recently this year on 5 February, the name of the company was changed to Varroc Engineering Ltd.

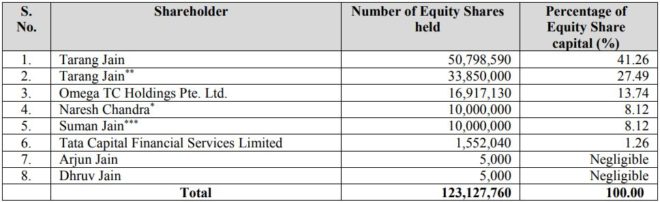

Varroc Engineering Ltd promoters’ shareholding breakup as on 18 March 2018 (date of DRHP filing).