A day after it rolled back a fare hike for suburban trains, the government on Wednesday failed to take a decision on the contentious gas price hike. A decision on gas prices is critical since $8-10 billion of investments from explorers such as Reliance Industries (RIL) are riding on it.

The UPA government had kept its January 10 notification to raise the price from $4.2 to around $8 per million British thermal units, based on the Rangarajan formula, in abeyance to comply with the electoral code on conduct (at the current level of formula benchmark prices, the new price could be lower at around $7/mmBtu).

Wednesday?s Cabinet Committee on Economic Affairs (CCEA) decision to maintain status quo on gas price for another three months has cast doubts, for the first time, on the Narendra Modi government?s ability to take bold steps to reinvigorate the economy.

Sources said many BJP leaders have reservations in implementing the formula worked out by former chief of the Prime Minister?s Economic Advisory Council C Rangarajan, especially after deft use of this issue in the hustings by Aam Aadmi Party leader Arvind Kejriwal.

Power and fertiliser companies say they can?t afford expensive domestic gas, as the price of their end product is not market-linked. Many analysts, however, say this stance defies logic given that the country would have no option but to import even more expensive LNG if the gas pricing regime is not investor-friendly.

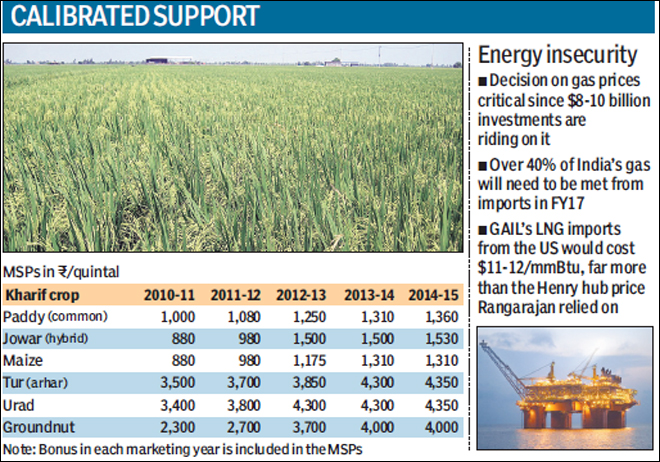

Over 40% of India?s gas will need to be met from imports in FY17. The LNG imports tied up by GAIL from the US would cost $11-12/mmBtu, much higher than the Henry hub price that Rangarajan has relied on.

While it chose not to decide on the gas price issue, the government, however, showed its reform impulses by announcing modest hikes of up to 4% in the minimum support prices (MSPs) of summer crops for the current marketing year starting September, even as the country stares at a drought with monsoon rains trailing the benchmark average by 38% so far.

The latest move is in stark contrast to the up to 53% hike in the MSPs of summer crops in just one year (2012-13), and an annual average of 14.8% in the five years through 2014-15, which was blamed for worsening the already sticky food inflation. Even the MSPs of crops such as bajra, maize, groundnut and soyabean (black) were retained at the last year?s levels by the CCEA, accepting the recommendations of Commission for Agricultural Costs and Prices (CACP) in totality.

Briefing news persons after the CCEA meeting, petroleum minister Dharmendra Pradhan said: ??The CCEA today decided that comprehensive discussions were necessary on the (gas price) issue and the guidelines (issued by the UPA government in January). It was decided that consultations would be held with all stakeholders and it was important to keep public interest in mind. Therefore, the CCEA has deferred this issue for a period of three months.??

Finance minister Arun Jaitley said there have been only one or two meetings on this issue, adding that the mechanism to review the gas pricing issue and reach a final decision needed to be finalised.

Deferring the price hike from April 1 when it was meant to take effect has already cost domestic gas producers some $2.8 billion in terms of unrealised revenue, according to Moody?s. The CCEA decision to continue with the current unremunerative price for another three months would mean a similar notional loss to them.

??This is a disaster decision. This will be impact ONGC?s profit after tax by about Rs 5,700 crore for FY15. Also, there would be around Rs 5-6 impact on the company?s earning per share,?? said a Mumbai-based analyst, who did not wish to be named.

Adding to gas producers? woes is the uncertainty about what the decision would be, when it is taken. It is unclear right now if the ??comprehensive discussions?? by Modi?s government would mean dumping the recommendations made by Rangarajan or tweaking them.

This move comes as a dampener for ONGC, which produces 60 million metric standard cubic metres per day (mmscmd) of gas, more than two-thirds of the country?s total production of the fuel. Ditto for Oil India, the other upstream oil producer.

A higher gas price for the current production would mean ONGC?s annual revenues would rise by Rs 12,000 crore and OIL?s by Rs 1,500 crore. For RIL and its partners, at the current KG-D6 output of 12-13 mmscmd, the annual revenue increase would be Rs 3,000 crore. If the gas price increases by $1/mmBtu, the per-tonne increase in production cost of urea will be Rs 1,369.50.

BJP leaders, including present minister for finance and defence Arun Jaitley, had said during campaigning for general elections that if they are elected the Rangarajan formula would be reviewed. The gas sale purchase agreements (GSPA) between RIL (the seller of gas from KG-D6) and buyers expired on March 31.

As for the farm sector, the Cabinet Committee on Economic Affairs (CCEA) raised the MSP of common-grade paddy by Rs 50, or 3.7%, to Rs 1,360 per quintal, much lower than the 7.2% increase in the five years through 2014-15. However, the marginal hikes didn?t come as much of a surprise given that in the drought year of 2002-03 the NDA government had raised MSPs of key grains paddy and wheat in the range of 0-1.6% to curb inflationary pressure, while in 2009, when India faced the worst drought in 37 years, the UPA government had increased them in the 8-11.8% region.

While farmers have flayed the move as too meagre to even mention, analysts say the latest hike signals the government?s seriousness about its stated priority of tackling inflation, especially food inflation, which hit an average of 12.16% in the wholesale market in the past five years. While wholesale price food inflation rose to 9.50% in May from 8.64% a month before, retail food and beverage inflation eased to 9.40% last month against 9.66% in April.

??Given the prevailing high inflation, this was best the government could do to accept the moderate hikes in MSPs, as recommended by the CACP,?? Ashok Gulati, chair professor (agriculture) at the Indian Council for Research on International Economic Relations and former CACP chairman, told FE.