Finance minister Arun Jaitley is likely to restructure import duties on a host of raw materials and intermediates in a bid to boost domestic manufacturing, which is central to the BJP?s vision of making India a global production hub. The manufacturing sector had suffered a 0.7% output contraction last fiscal.

Finance ministry sources said correcting the inverted duty structure ? or the problem of raw materials being subjected to higher taxes than the finished products ? was a priority and had therefore asked for specific inputs on products, their uses, turnover and other details from industry. It is also part of the finance ministry?s broader objective of simplifying the tax structure.

The idea is to ensure to the extent possible that import tariffs are graded in such a way that in any value chain finished products attract the highest duty, the intermediates relatively lower taxes, and raw materials the lowest.

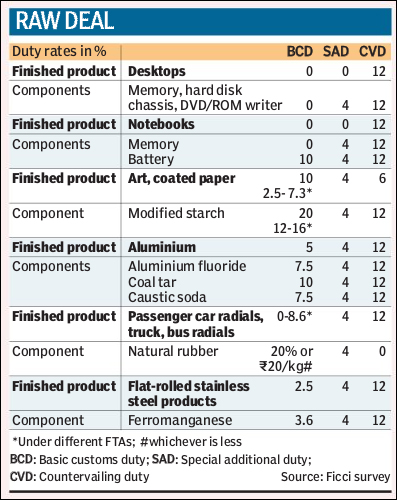

Giving tariff protection to certain items in a product?s value chain or allowing concessional import of final products under various free trade agreements (FTAs) discourages the use of imported raw materials for local production of final goods. Although this issue had been identified a decade ago and based on suggestions from expert committees, corrective steps have since been taken in case of several industrial sectors, the problem lingers in sectors like automobile components, IT and electronic products, some petrochemical products, paper, edible oil, tyres, pharmaceuticals and capital goods.

The solution involves reducing the basic customs duty (BCD, which represents import tariff) on imported raw materials to below the level of that on finished products or at least to bring parity.

Scrapping or lowering the 4% special additional duty (SAD) could also help address the issue partially. SAD was introduced to equalise the tax incidence on an imported item with that of a locally produced item, which earlier attracted 4% central sales tax. Since CST has now been reduced to 2%, the comparable tax on imported items too need to be brought to the same level, explained Pratik Jain, partner, KPMG.

If an imported component attracts 12% countervailing duty (CVD) and another 4% SAD on that, the total duty incidence on the raw material comes to 16.48% (assuming basic customs duty is zero), but the domestic producer of the final product would be able to avail of tax credit only against the 12% excise duty payable on the finished product. This leads to accumulation of input tax credit, which a local manufacturer will never be able to utilise.

?In the case of IT and electronic products (where the BCD is zero), the prevailing CVD of 12% and SAD of 4% is a major disincentive for local manufacturing as the effective duty rate on account of CVD and SAD comes to approximately 16.48% as against the effective excise duty rate of 12.36% on finished products. The above anomaly can be addressed by aligning the duty rates on inputs vis-?-vis finished goods,? said Jain.

Similar examples of perverse duty incidence affecting the use of imported components in local production of finished goods are seen in the case of toilet soaps, PVC, tyres, paper and edible oils, too.

?Correcting the inverted duty structure is very difficult because the same raw material may be used in different industries where imported finished products attract different rates of duty. One way to address it is to give duty relief or exemption for specific end use of raw materials. But this may have the flip side of requiring inspections to ensure that the relief is being claimed for intended end uses,? said Ajai Sahai, director general, Federation of Indian Export Organisations.

According to Krupa Venkatesh, senior director, indirect taxes, at Deloitte Touche Tohmatsu India, the problem of inverted duty is prominent in sectors like edible oil, cement, steel, aluminium, chemicals, tyres, pharmaceuticals, pumps, tractors and paper.

Tyres, for example, attract only a 10% BCD compared with 20% or Rs 20 a kg (whichever is lower) in the case of natural rubber, its principal raw material.

?Besides, tyre imports enjoy preferential duty under India-Asean FTA, Sri Lanka FTA and the Singapore CECA (comprehensive economic cooperation agreement) which leads to imports at concessional rates ranging from 0% to 8.6%, increasing the incidence of inversion,? she said.

In the case of pharmaceuticals, imported active ingredients attract 12% customs duty, while finished products attract only 6%, leading to accumulation of tax credit, said Venkatesh.