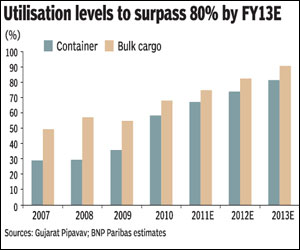

GPPL has incurred losses every year in the past five years. The losses were primarily a combination of factors, including low capacity utilisation (less than 50%), low container realisations and high interest costs.

We expect capacity utilisation to grow to 72% for the container business, driven by recent investment of R2 bn, which has improved the company?s container-handling facilities at the port. GPPL was forced to offer heavy discounts to shipping lines during the global recession (FY08-09) to attract higher volume. The company has since been able to increase rates by about 40%, leading to higher profitability. Despite the increase in rates, per-tonne container realisation remains competitive, including that with the Mundra and JNPT ports

We expect capacity utilisation to grow to 72% for the container business, driven by recent investment of R2 bn, which has improved the company?s container-handling facilities at the port. GPPL was forced to offer heavy discounts to shipping lines during the global recession (FY08-09) to attract higher volume. The company has since been able to increase rates by about 40%, leading to higher profitability. Despite the increase in rates, per-tonne container realisation remains competitive, including that with the Mundra and JNPT ports

GPPL has managed to repay some of its high-cost debt, partly from the IPO (Sept 2010) proceeds and partly from internal cash-flow generation. Thus, net debt has reduced from R10 bn to R6bn, which has improved the debt-equity from 3.3x (times) in 2009 to 0.8x in 2010. With balance-sheet concerns largely addressed, we believe GPPL can now focus on growing traffic and expanding capacity.

We expect GPPL to turn positive at the PAT level in 2011, mainly due to an improvement in realisations, an increase in volume and a decline in interest costs. We expect GPPL to register ROE (return on equity) of 14.1% by 2013.

According to Crisil, container traffic at India?s major ports has increased at 15.8% CAGR (compound annual growth rate) in the past five years. It also expects container traffic to grow at about 11% in the next five years. Our estimates for Pipavav factor in an above-industry average CAGR of 12% for container traffic growth over FY11-16, driven by higher contribution from Maersk line (promoter group) and increasing market share in the overall container business.

APM Terminals is the promoter of GPPL. APM Terminals is part of the APMM group, which has over five decades of experience in the logistics business (ports, containers, shipping, etc). APMM has contributed about 34.2%, 22.5%, 26.2% and 30%, respectively, to the total revenue of GPPL in the past four years through its two shipping lines, Maersk Line and Safmarine Container Lines.

Based on our checks with industry participants, a shipping line/importer/exporter considers six major parameters to select a port for unloading/loading the goods. Mundra and Pipavav have an advantage on five of the six parameters indicating potential for a gradual increase in their market share in the future.

The Pipavav port currently has bulk-handling capacity of 5m tonnes per annum, most of which caters to coal imports and fertilisers. Looking ahead, there is potential to grow bulk volumes as several power plants are being set up in the vicinity. However, our India utilities analyst, Girish Nair, believes that these plants are in very early stages of development and lack visibility. Our estimates ignore the potential growth in the bulk business as we have not factored in the corresponding capacity expansion in the bulk business (can grow from 5m tonnes to 15m tonnes).

We believe the Pipavav and Mundra ports are likely to benefit the most from undercapacity at JNPT and Mumbai Port. In 2010, JNPT and Mumbai Port were operating at a capacity of more than 100%. Furthermore, industry participants foresee no significant capacity addition in these two ports in the near term.

We believe Pipavav is best positioned to capture any incremental growth in container traffic at JNPT and Mumbai Port. Pipavav is the closest port with good infrastructure and connectivity to JNPT. It is about 150 nautical miles and 10 hours shipping time from JNPT, making it an attractive alternative. In addition, Pipavav has a deeper draft and better infrastructure compared to the JNPT and Mumbai ports. Shortcomings in the frequency of rail connectivity have been the key drawback of Pipavav, according to industry participants.

A common investor concern for the Pipavav port has been its ability to compete with larger ports such as Mundra. However, our checks with shipping lines suggest that there is no major threat as Pipavav has locational advantages, is cost competitive, and has comparable infrastructure links.

Our channel checks with shipping lines operating in Mundra and Pipavav ports suggest that Mundra and Pipavav are preferred for better connectivity to hinterland, shorter distance from JNPT (India?s biggest container port) and lower cost. These ports are likely to see higher volume gains especially on the container front.

Between Mundra and Pipavav however, majority of the shipping lines tend to prefer Pipavav for its locational advantages, cost competitiveness, and comparable infrastructure links.

Pipavav managed to increase the number of shipping lines calling on the port in FY10. Pipavav secured eight new container lines and provided five new services in FY10. We initiate coverage on GPPL with a Buy rating and TP (target price) of R73, based on a two-stage DCF (discounted cash flow) model. Our TP implies upside potential of 21.5% from current levels. We assume a nominal growth rate of 5% and weighted average cost of capital of 11% to arrive at our DCF-based target price.

We have factored in capacity expansion only for the container business, from 0.6m TEU to 1.2m TEU by FY14e. As we have limited visibility on the bulk business, our estimates do not capture the potential growth and capex deployment from the same. GPPL can potentially expand its bulk capacity from the current 5m tonnes to 15m tonnes and container capacity from 1.2m TEU to 3.6m TEU, subject to regulatory approvals.

?BNP Paribas