On the back of strong operating margins, the top four IT services companies have reported good growth in net profit for the last quarter of FY14 with a majority of them indicating better visibility ahead as demand grows. The companies are largely positive on the new fiscal with most of them reporting strong pipeline. The industry body Nasscom has also projected a higher growth for the current fiscal at of 13-15%, as against the 12-14% for FY 14.

Bangalore-based Wipro, which was seen as a laggard till Q3, saw its operating margins go up by 150 basis points (bps) touching 24.5% at the end of fourth quarter, its highest in three years. Its peer from the city, Infosys also saw its operating profit margins rise by 50 basis to 25.5% in the March quarter boosted largely by cost optimisation measures.

Meanwhile the largest software exporter Tata Consultancy Services (TCS) has reported an operating margin of 29.1%, which reflected a year-on-year (y-o-y) growth of 210 bps, widening its gap with other big IT firms. Delhi-based HCL Technologies also showed a sequential growth of 7.1% in its Ebit margin, which stood at 24.6% for the last quarter.

The top IT services companies are largely confident about the demand in healthcare, retail, banking, auto and pharma while most of them see spending cuts in retail, insurance and high-tech. They reported a strong deal pipeline which indicated some confidence about the volumes and realisations for the current fiscal with growth momentum expected to continue for a few quarters.

The companies are also creating separate divisions for new growth areas in the sector and are seeing huge growth in the digital system integration business. HCL president and CEO Anant Gupta said that the company is expecting that the business will get to scale and size in three years. The company also got one large deal in this space during the March quarter. TCS said that it will be a $3 billion market in a few years.

While Wipro CEO TK Kurien, who announced a new independent unit Wipro Digital, said that there is demand for leveraging new digital technologies in optimising technology spends and also to differentiate in the marketplace. ?We see value at the intersection of physical and digital. We need a new business unit as the DNA is quite different and won?t succeed in the same environment and need a different leadership. We cannot mix both DNAs,? he said.

TCS

TCS reported a net profit of Rs 5,297 crore, up 2.3% sequentially on the back of a rise in revenues to Rs 21,551 crore, an increase of 1.2% quarter-on-quarter (q-o-q). The numbers were supported by a 2.6% increase in volumes, stable pricing and a pick- up in business across a host of geographies led by Europe and Asia Pacific. India?s biggest software services exporter ended FY14 with revenues of Rs 81,809.4 crore, up 29.9% and net profit of Rs 19,116.8 crore, up 37.5%. In dollar terms, TCS? revenues in FY14 rose to $13.4 billion, up 16.2% while profits rose to $3.1 billion, up 22.9%.

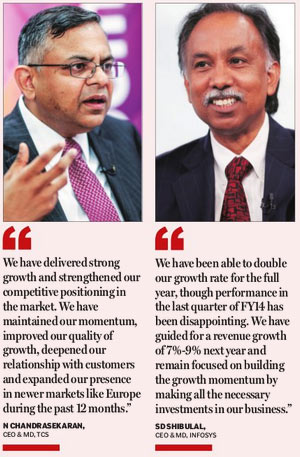

N Chandrasekaran, managing director and CEO, said that the current year would be a stronger one for the company based on the discussions with clients, the deal pipeline, the general sentiment and the trends in discretionary spends. ?We are getting positive feedback from our clients and we believe there is good growth momentum,? Chandrasekaran said, adding that customers appeared to be focussed on IT spends in three areas, namely simplification, digital and governance. He added that the flat trend in pricing will continue for some time and the growth will come from volumes. At the end of March, TCS had 24 clients with revenues of $100-million plus.

Infosys

The country?s second largest software services exporter beat street estimates with better margins that drove a 25% year-on-year growth in net profit for the March quarter of FY14. It forecast a 7-9% dollar revenue growth for FY15 that was in line with expectations but is below its own growth rate of 11.5% in the last fiscal.

Infosys saw its annual revenue cross Rs 50,000 crore and net profit crossing Rs 10,000 crore this fiscal with the company?s cash pile reaching Rs 30,000 crore at the end of the fiscal.

Infosys reported net profit of Rs 2,992 crore for the quarter ended March as against Rs 2,394 crore in the year ago period while it grew 4.1% over profit of Rs 2,875 crore in the October-December period. The company?s revenue grew 23.2% to Rs 12,875 crore as against Rs 10,454 a year ago, while it declined 1.2% sequentially.

?I am pleased that we have been able to double our growth rate for the full year compared to last year, though performance in the last quarter of FY14 has been disappointing.? said SD Shibulal, CEO and managing director. ?We have guided for a revenue growth of 7%-9% next year and remain firmly focused on building the growth momentum by making all the necessary investments in our business.? He added that clients were undergoing cost optimisation drive and cutting down their discretionary spend, terming the demand environment as volatile. Infosys added 50 clients during the fourth quarter of FY14, which is lower than the comparable sequential period, taking the total number to 890.

The company has improved its employee utilisation?including trainees?by 4% over the previous fiscal at 73.6% as against the 69.5% it reported for the previous fiscal. The utilisation rate excluding trainees stood at 78% at the end of FY 14. The IT sector?s largest market, North America showed a decline of 0.8% sequentially for the company. Europe grew by 1% q-o-q while demand from India remained flat at 0.1%. The rest of the world also saw the demand declining by 1.5% for the same period. Banking, financial services and insurance segment, the largest industry segment for the IT giant, saw a decline of 0.5% sequentially.

Wipro

India?s third largest IT services exporter saw its net profit rise by 41% for the fourth quarter ending March, 2014 driven by higher productivity and automation. The company also sounded optimistic of FY15, providing a revenue growth guidance for the first quarter in the range of -0.3 to 2%, though it is lower than 2-4% range provided in the previous sequential period. ?We always had a poor first quarter and much should not be read from the guidance. We expect linearity in our performance and growth coming back in Q2. We are affected by the seasonality of India business being low in the Q1 and the low retail business. The first quarter cannot be seen as a precursor to the full year,? said Kurien.

At the end of the fourth quarter of FY14, the net profit of Wipro touched Rs 2,230 crore and as against Rs 1,737 crore it reported for the same period of the previous fiscal. The revenue from IT services was Rs 11,653 crore at the end of the fourth quarter as against Rs 9,607 crore it reported for the corresponding period of previous fiscal, recording a y-o-y rise of 22%. The consolidated revenues including the hardware business crossed $2 billion for the quarter. For FY15, the consolidated revenue touched R43,760 crore and a net profit of R7,800 crore.

?The steady improvement in global economy, coupled with the exciting pace of technological advancements, presents us with opportunities to create innovative solutions to help our customer differentiate, compete and succeed in their respective markets,? said Wipro chairman Azim Premji. The growth rates of Wipro across geographies – US, Europe, India & Middle-East was higher than the company?s overall average with the only drag being Asia Pacific and other emerging markets, which saw a sequential decline of 4.1%.

HCL Technologies

HCL also saw its numbers beating estimates and reported a 59% growth in its net profit for the quarter. It reported a net profit of R1,624 crore for the third quarter?the company follows July-June fiscal? ended March 31, 2014, compared with R1,021 crore it posted in the corresponding period of the previous fiscal. The revenue stood at R8,349 crore for the period as against R6,430 crore it reported during the same period of the previous fiscal, a growth of 30%.

HCL Tech added two clients each in the $50 million and $30 million categories in the quarter. The company said that it signed 12 transformational engagements in the quarter totalling over $1 billion in contract value led by financial services and manufacturing verticals in the US and Europe. The firm is eyeing capital expenditure of 3.4% of the revenue in current quarter.

?We continue on our growth momentum with strong revenue growth along with the 10th straight quarter of margin expansion. The application services business registered a robust performance led by digital systems integration proposition on the discretionary side. Infrastructure services have continued to punch their weight in the market,? said Gupta.

Human resources

TCS will hire 55,000 employees this fiscal, of which the campus recruitment of 25,000 have been completed. In FY14, the company hired 61,200 people and the head count has crossed the 300,000 mark. The attrition rate stood at 11.3%. The company announced wage hikes of 10% for India employees, with a 14%-plus increment for high-level performers; the hike in developed markets is 2-4% while in developing markets it is 4-6 %.

Meanwhile Wipro, which hired just 241 people in FY14, said that the trend is likely to be the same for the current fiscal too. At the end of the March quarter, the total employee strength was 146,053 as against 146,402 in the year-ago period, showing a decline of 349, even as the attrition rate rose sequentially by 0.8% to 15.1%. Wipro has also announced a salary increase in the range of 6-8% for offshore employees and 2-3% for onsite, effective from June 1.

Infosys had a net addition of 2,000 employees during the quarter with the total number of employees on its rolls rising to 1,60,405. Despite the two salary hikes announced by the company recently, the attrition climbed to 18.7% as against the 18.1% it reported in the previous quarter. HCL had a net addition of 1,858 during the quarter with the total headcount raising to 90,190.