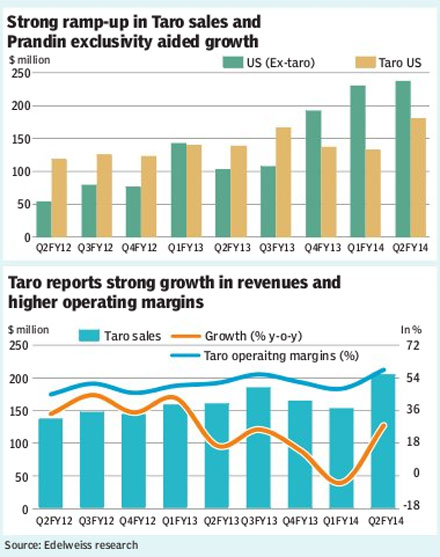

Strong performance across regions: Sun Pharmaceuticals Industries Q2FY14 adjusted profit after tax at R13.6 bn was ahead of estimated Rs 12.9 bn primarily due to strong sales and margins of Taro. Taro sales grew 27.5% year-on-year to $205m, while it operating margins scaled up by 740bps to 58.6%. Sun base business margins were 35.3%, lower than 41% in Q1FY14 and 38% in Q2FY13, which highlights that disproportionate benefit to margins from DUSA/URL (acquired companies) is not likely to sustain.

Going forward, we see continued benefit from Prandin exclusivity and higher sales in Doxil (post J&J withdrawal) to benefit Sun?s growth and profitability. We revise up our estimates for FY14/15e by 14%/12% to factor in (i) higher currency realisation, (ii) better growth in Taro, (iii) increased guidance of 25% growth in constant currency and (iv) lower tax rates. While we see higher risk to earnings from non-sustainability of margins, strong execution would sustain relative premium to peers. We maintain ?Hold? rating on the stock.

Strong all-round performance across regions: Sun depicted revenue growth of 58% led by strong operating performance across regions. India business remained resilient with 17% growth despite challenging environment. ROW (rest of world) markets grew by 17% (constant currency), while US registered growth of 72% (constant currency). Ex-Taro/ Prandin sales, US base business was down to $187m from $200m quarter-on-quarter as the company had strong benefit from DUSA and URL in preceding quarter, which is not sustainable.

Margins upside capped despite currency weakness: Sun?s overall Ebitda margins at 43.8% were stable despite strong currency realisations, as the company does not book unrealised forex gains on inventory. We estimate margins to come off directionally from higher base of 44% in FY14e to 41.6% in FY16, which would restrict earnings growth.

Outlook and valuations: Sun?s business model remains resilient due to its strong product portfolio and continued focus on niche and complex molecules, which is likely to sustain premium valuations to peer. Our revised target price of R632 (R540 earlier) values base business at 22.5x Sept-15 core EPS and assigns R12 as NPV (net present value) value for Para-IVs.