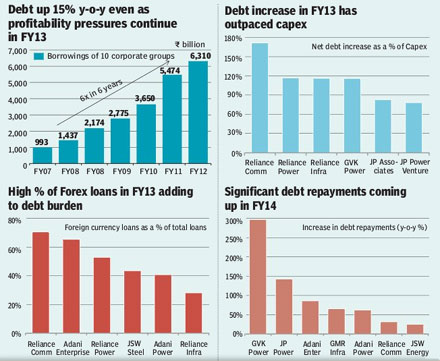

A year after our 2012 House of Debt report, we revisit the ten corporate groups featured in our earlier report. Over the past year, debt levels at these groups have risen by 15% year-on-year even as profitability continues to be under pressure. The largest increases have been at groups such as GVK, Lanco and Anil Ambani group (ADA) where the gross debt levels are up 24% y-o-y. For most of these corporate groups, the debt increase even outpaced capex. Asset sales?key for de-leveraging for most of these?have still not taken-off; only GMR and Videocon Industries Ltd have had some success on that front.

However, despite asset sales, GMR?s debt is up 15% y-o-y. The increasing stress is visible with some loans of Lanco, JPA (Jaiprakash Associates) and Reliance ADA having already come up for restructuring.

Top ten firms? debts continue to rise

Loans to these firms up 15% y-o-y: Over the past year, profitability at most of these groups has continued to be under pressure and their aggregate debt levels have increased.

Projects already undergoing restructuring: Lanco Infratech Ltd has already begun talks with banks for the restructuring of R75 bn of debt in the standalone business. Banks have also restructured part of the debt for Reliance Power?s 3,960 MW Sasan UMPP that is expected to commission most units in FY14. Jaiprakash Associates Ltd‘ R32 bn 500 MW Bina-I has undergone restructuring during the quarter, with Punjab National Bank (PNB) restructuring Rs11 bn of the loan during Q1FY14.

Asset sales will likely be key to deleveraging: While several groups have been looking to deleverage, only a couple of asset sales were successfully concluded over the past year. Even after an asset sale, GMR‘s debt levels have increased by 13% from R360 bn to R408 bn. While Adani Ports has sold Abbott Point asset to the promoters, it still has an outstanding corporate guarantee for $800m, as a result of which its liability hasn?t reduced significantly.

Debt servicing ratios under pressure: With rising debt levels, interest cover for most of the groups has declined further. Aggregate interest cover for these top ten groups has dropped from 1.6x to 1.4x (times). Interest cover ratios at groups such as Essar, GMR, GVK and Lanco are already under 1. Interest cover at Adani and Jaypee have also fallen to <1.5x. Interest coverage ratio has come down from 1.2x to 0.6x for Lanco Infratech, as its interest cost has increased 130%, while Ebit has risen only 14%. For GVK infra, the coverage ratio has come down from 1.0x to 0.4x.

Weakening rupee could cause further pain in FY14: With the 6.7% currency depreciation in FY13, corporates such as Reliance Communications, Adani Enterprise and JP Associates have seen a forex hit equivalent to their FY13 PAT. With the rupee down 12% since Mar-13, the liabilities on account of this must have increased further.

FY14: The year of reckoning? With over 13,000 MW of power capacity from these groups scheduled to be commissioned the current year will be critical. Companies such as Adani Power, Reliance Power and GMR Infra would see their operating capacities double if the projects were to come on stream as expected. However, delays in these projects could result in more of their debt being restructured. The cash flow strain is also likely to intensify as debt repayments are 30-150% higher y-o-y in FY14 and repayments due are 2-18x their FY13 profits.

While Indian bank NPAs have already moved up from 2.5% to 4% of loans, most of these has been on account of rising delinquencies in agri, SME and mid-corporates. Large corporate NPLs are still low; for example 1.7% at SBI, where 5.6% of total loans are now NPLs. As a study of these ten groups reveals, the over-leverage in the large corporate segment is high and is a potential source of additional asset quality stress for banks. As also highlighted in our recent reports, corporate asset quality issues are likely to persist and we continue to remain Underweight on the Indian Banks despite the recent stock price fall and cautious on corporate lenders such as State Bank of India (SBI), ICICI Bank, Yes Bank Ltd, Union Bank, PNB, and Bank of India.

?Credit Suisse