While company deposits offer high returns, look out for the rating and not just yields

With softening interest rates, companies are now launching fixed deposits for individuals offering higher effective annual yield than bank fixed deposits. The corporate deposits come at a time when non-banking financial companies like Shriram City Union Finance, Religare Finvest, Muthoot Finance and SREI Infrastructure Finance have also launched non-convertible debentures.

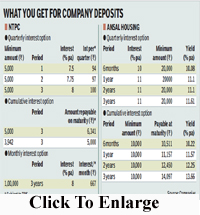

Public sector enterprise NTPC has launched public deposits schemes with four investment options ? non-cumulative quarterly and monthly interest payouts and cumulative interest payout with minimum deposits of R5,000 and R3,942 for three years. The interest accrued is subject to tax deduction at source. However, there is no TDS if the total interest income does not exceed R5,000 during a financial year. There is an option for depositors to receive interest and repayment through e-payment.

The company is giving an option of monthly interest payment on a single deposit of R1 lakh for three years. The monthly interest payout is R667 and the interst rate is 8%. The monthly interest payout works like a Post Office Monthly Income Scheme (MIS) which currently offers interest of 8.5% p.a. The maturity period of post office MIS is five years, but it can be prematurely encashed after a year with some conditions. No bonus is admissible on maturity for post office MIS accounts opened on or after January 1, 2011. The maximum amount that one can invest in a single MIS account is R4.5 lakh (R9 lakh in a joint account).

The company is giving an option of monthly interest payment on a single deposit of R1 lakh for three years. The monthly interest payout is R667 and the interst rate is 8%. The monthly interest payout works like a Post Office Monthly Income Scheme (MIS) which currently offers interest of 8.5% p.a. The maturity period of post office MIS is five years, but it can be prematurely encashed after a year with some conditions. No bonus is admissible on maturity for post office MIS accounts opened on or after January 1, 2011. The maximum amount that one can invest in a single MIS account is R4.5 lakh (R9 lakh in a joint account).

NTPC has the FAAA credit rating by Crisil, which denotes highest safety regarding timely payment of interest and principal. The scheme offers quarterly interest with minimum amount of R5,000 and in multiples of R1,000 thereafter for a period of one, two and three years. The rate of interest is 7.5% for one year, 7.75% for a two-year deposit and 8% for a three-year deposit. The interest payout will be quarterly compared with a bank deposit where it is usually on an annual basis. Currently, SBI is offering an interest rate of 8.5% for a one-year-to-less-than-two-years period for deposits below R15 lakh. For deposits beyond two years, the bank is offering the same rate but the annualised yield increases for the longer tenure.

The cumulative interest payout option of the NTPC deposit for a minimum amount of R5,000 will be R6,341, repayable at maturity after three years. And for a minimum deposit of R3,942, the maturity amount will be R5,000 for a three-year period. The company is giving an option of premature withdrawal. Nomination facility is also available.

Similarly, Ansal Housing and Construction has come out with public deposits with three options ? quarterly income, cumulative income and monthly income. It is offering higher rates than NTPC deposits and the minimum deposit is R10,000 for cumulative income and R20,000 for quarterly income deposits. For a quarterly income deposit, it is offering an interest rate of 10% for a six-month deposit; 11% for one- and two-year deposits and 11.5% for a three-year deposit. For a monthly income deposit, the minimum amount is R20,000 for a period ranging from six months to three years and the rate ranges from 10% to 11.5%. Analysts say one should invest in company fixed deposits rated AA or above and should avoid corporate deposits that offer abnormally high yields. All company fixed deposits are unsecured unlike a bank fixed deposits where up to R1 lakh is guaranteed in case of the bank defaults. An investors will have to depend on the cash flow of the issuer for timely receipt of interest and principal. Moreover, individual deposit holders are much lower down the pecking order when it comes to repayment if a company is bankrupt.

One must always check the credit rating of the issuer before investing in a company. Analysts also say a depositor should look at a short tenure to invest in company deposits. In general, two categories of companies float public fixed deposits ? non-banking financial companies and those in manufacturing, utilities, real estate, services and even consumer durables. As per the rules of the RBI, an NBFC will have to procure a credit rating from one of the rating agencies and the rating will have to disclosed to the investor in the prospectus. The RBI has made it mandatory for NBFCs to have an ‘A’ rating to be eligible to accept public deposits, but it is not mandatory for others. Analysts say as a rule, an investor must choose a rated company fixed deposit over an unrated one. Instead, one can deposit money in bank fixed deposits, which are safer than unrated company fixed deposits.