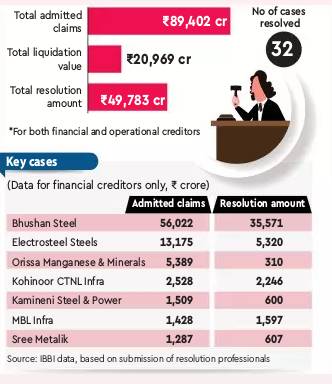

Creditors have recovered Rs 49,783 crore, or almost 56% of their admitted claims, from 32 stressed companies where insolvency resolution plans were approved by the National Company Law Tribunal (NCLT) by the end of June, showed data compiled by the insolvency regulator. Despite the average 44% haircut that the creditors in general had to take in these cases, analysts said the Insolvency and Bankruptcy Code (IBC) has performed much better than the earlier system where the recovery process was strenuous and yielded too little. Of course, the headline numbers are good primarily because of Bhushan Steel, which accounted for close to 64% of the total claims by these 32 firms and an equal amount in recovery.

Financial creditors, such as banks, have managed to recover Rs 47,768 crore, or a little over 55% of their claims, showed the data by the Insolvency and Bankruptcy Board of India, compiled on the basis of the inputs provided by resolution professionals (RPs). Operational creditors — including raw material suppliers — have received Rs 2,015 crore, making up for 61% of their claims.

Financial creditors, expectedly, made up for the bulk (96%) of the total claims admitted by RPs. “The IBC is way better than the earlier system, where recovery used to take a lot of time, and wherever a one-time settlement took place, the amount was usually not more than 20-30%. Also, many stressed firms were allowed debt restructuring, which further worsened their state of health. In contrast, the IBC stipulates a time-bound resolution of default cases, which is good,” said Manoj Kumar, partner and head (M&A and insolvency resolution services) at consultancy Corporate Professionals Capital.

However, analysts said the ratio may change for the worse in the coming weeks once the resolution process of some of the large stressed companies such as Bhushan Power and Steel, Lanco Infratech and Alok Industries are factored in, as haircuts in these cases are expected to be much higher. For instance, against the admitted claims worth Rs 47,000 crore by financial creditors, the highest offer (by JSW Steel) is only Rs 19,350 crore. Lanco Infra, with Rs 45,263 crore in debt from financial creditors, is feared to be heading for liquidation as the lenders have reportedly rejected an offer. In case of Alok Industries, against the debt of Rs 29,500 crore, Reliance and JM Financial have placed a joint bid of only Rs 5,050 crore.

Nevertheless, once these old cases — where chances of a grand turnaround without massive investments are remote — are settled and new cases come in, recovery would be much higher, a senior government official said. This is because creditors can invoke insolvency proceedings against defaulting firms very early when chances of turning them around would be much higher and easier.

Interestingly, in nine of these 32 cases, insolvency proceedings were triggered by the corporate debtors themselves, while 14 were by financial creditors and nine by operational creditors. As many as 12 cases were handled by the NCLT’s Kolkata bench, and eight by the Mumbai bench.