Upgrades by rating agencies & easing crude oil prices help rebuild growth story

The recent bout of risk-aversion and panic selling brought the Indian equity market on its knees, but that did not stop the country’s benchmark equity indices from featuring among the best performers this calendar year. Experts say that plenty of upgrades by international rating agencies and global investment banks, owing to attractive valuations and easing crude oil prices, have helped in rebuilding India’s growth story among the investor fraternity.

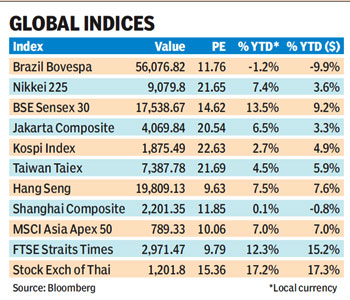

Global institutions like UBS, Morgan Stanley, Deutsche Bank, J P Morgan and Moody’s Investor altered their stance on Indian equity markets, citing attractive valuations. The recent under-performance brought the valuations of the Indian market near the 2002 and 2008 levels, they say. The 30-share Sensex has given returns of 13.5% so far this calendar year, which makes the India index stand among best Asian and emerging market performers. The Stock Exchange of Thai Index and FTSE Straits Times Index continue to lead the pack with 17.2% and 12.3% returns, respectively.

Global institutions like UBS, Morgan Stanley, Deutsche Bank, J P Morgan and Moody’s Investor altered their stance on Indian equity markets, citing attractive valuations. The recent under-performance brought the valuations of the Indian market near the 2002 and 2008 levels, they say. The 30-share Sensex has given returns of 13.5% so far this calendar year, which makes the India index stand among best Asian and emerging market performers. The Stock Exchange of Thai Index and FTSE Straits Times Index continue to lead the pack with 17.2% and 12.3% returns, respectively.

?You have to put your money somewhere. Globally interest rates are drastically low, which prompted foreign funds to invest in India. Improved valuations, just like in 2000 and 2008, increased investor risk appetite despite all the negative sentiments,? said Andrew Holland, CEO ? investment advisory, Ambit Capital. Interestingly, performance of Indian indices have also improved on the back of sharp turnaround in the rupee. The 30-share Sensex, which was trailing most of its Asian and emerging market peers, has given returns of 9.2% in dollar terms far lower than sub-3% returns in June.

According to Bloomberg data, rupee appreciated 3.85% to 54.955 on Thursday from its all time lows of 57.155 on June 22. Experts said that Sensex’s year-to-date (ytd) performance was adversely affected due to more-than 20% depreciation in the rupee since February end.

?Easing crude oil and commodity prices will help lessen inflation. As a result, you could begin to see less burden on fiscal and current account deficit, which will help the rupee regain its lost ground. Prompt action and timely initiatives by the government will help bring foreign funds, both FDI and FII, into India,? said Rakesh Arora, MD & head of research-India, Macquarie Securities.

Among the leading emerging market indices, Brazil’s Bovespa continues to be the worst performer, with ytd gains recorded at -1.2% in local currency terms and -9.9% in dollar terms.