A near 6% correction in the Indian stock markets over the last three trading sessions and from the start of the year has led many analysts and investors to start looking for good quality stocks being offered at great bargains due to the selloff in the broader markets.

A section of the Street is hailing the correction as a buying opportunity with many bluechip stocks dipping below long-term valuations measures. As per Morgan Stanley, apart from low valuations on some counters, some of the sentiment indicators are in oversold territory as well. Morgan does not rule out a market rally based on this observation, although it says that until the fundamental construct changes, this is will be a rally to sell and not buy.

According to Nirakar Pradhan, CIO, Future Generali Life Insurance, investors tend to flock towards defensive sectors in the current scenario. ? The latest correction also gives opportunity to accumulate strong blue chips across sectors that can be obtained by a bottom-up preference for longer investment horizon,? believes Pradhan.

Given the backdrop of a weak Indian rupee vs US dollar, low leverage and moderate forex liabilities may be the key parameters to consider while looking at bluechip stocks that also offer good value, says Pradhan.

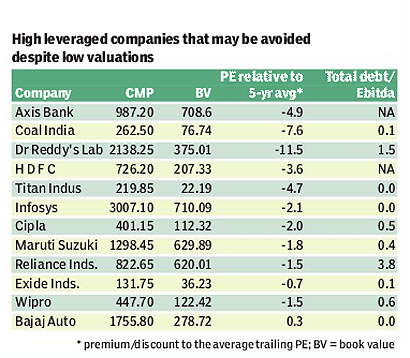

These may include large caps that are trading at discounted valuations and are placed to benefit from their niche positioning in the sector. Shares like Coal India, Larsen & Toubro (L&T), HDFC, Infosys, Dr Reddys Laboratories (Dr Reddy’s), Reliance Industries (RIL) and Titan Industries Ltd may be part of this universe.

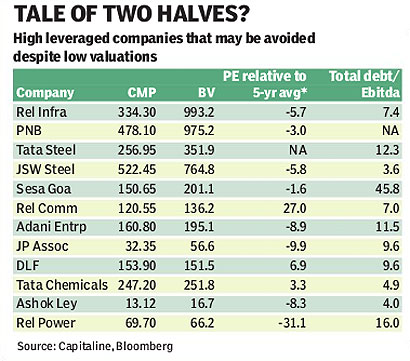

After the recent market correction, at least a fifth of the BSE 100 companies is currently trading below respective book value. Further, almost 70% of the sample companies are trading below their five-year average price-to-earnings multiples. Most of these companies belong to sectors like banking, infra, power, capital goods and metals that have higher sensitivity to the slowdown in capex cycle of India Inc as well as the broader slowdown in growth.

Analysts, however, are cautious about looking at high debt companies even though many of these are also available at attractive valuations. From the BSE 100 universe, a majority of large caps that seem to offer great value also have heavy debt obligation, which could lead to further erosion in profitability of these companies and their ability to meet interest coverage needs. Companies that fall in this category include Reliance Infra, Adani Enterprise, JP Associates, Tata Steel and JSW Steel Ltd. For these names, operating incomes were significantly lower than their total debt in 2012-13.

As a fallout of the increased debt pressure on corporate balance sheets, analysts have also grown increasingly cautious on the banking space despite attractive valuations, especially among PSU banks. Brokerages like Macquarie, Morgan Stanley and Goldaman Sachs have downgraded various banks, linked to concerns around asset quality.

In a recent research note, Credit Suisse has highlighted that the debt level of the 10 leading corporate groups, including Adani Enterprise and Reliance ADAG Group, has risen by 15% in the current fiscal compared to FY12. The brokerage expects project delays from some of these companies to lead to further restracturing of loans.