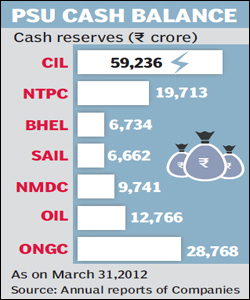

Public sector enterprises that fail to follow announced expansion schedules must cough up special dividends this fiscal, as a fiscally-stressed government looks to tap into these cash-rich entities. Central PSUs are currently sitting on more than R1.88 lakh crore and many of them are either drawing up large expansion projects or implementing them.

According to official sources, the finance ministry has asked these companies to either step up investment in the current fiscal to boost the economy or shell out more as interim dividends to help the government rein in the fiscal deficit.

According to official sources, the finance ministry has asked these companies to either step up investment in the current fiscal to boost the economy or shell out more as interim dividends to help the government rein in the fiscal deficit.

Against the Budget target of 5.1% of GDP, fiscal deficit is projected to rise to over 6% of GDP this year, limiting room for private investors to access funds at economical rates.

Seventeen state-owned companies provided the government about R17,000 crore as interim dividend in 2011-12, a growth of over 36% over the previous fiscal. The government wants to improve the figure this year and early indications have already been given to PSUs, said a source privy to the development.

?Paying interim dividend is a regular exercise followed by PSUs. We expect to finalise the payout while putting together the third quarter results of the company,? said the head of a PSU, asking not to be named.

The matter, the source said, came up for discussion during a recent meeting of PSU chiefs with the finance minister. Even though the meeting ? attended by chief executives of CIL, NTPC, Bhel, NMDC, MMTC, ONGC, OIL, SAIL and IOC ? discussed ways of improving investments in a time-bound manner, the clear message from the government was that PSUs faltering on investment commitments must put their money into the central coffer.

The Kelkar panel on fiscal consolidation too has said that central PSUs with large cash balances should either speed up sound investment or the government should call for a special dividend on a ?use-it-or-lose-it? principle.

The government’s stand also stems from the fact that several of these companies have very modest immediate investment plans not commensurate with their large cash balances. For instance, CIL has over R50,000 crore cash and bank balances but has investment plans of just about R4,000 crore this year. NMDC is spending just over R4,500 crore this year though it has over R20,000 crore.

The government had also looked at asking cash-rich public sector enterprises to buy back their shares from it given the difficulty to raise funds through public offers in uncertain markets. However, this plan was put on hold after severe objection from some companies.