MF houses have been asked to launch direct schemes where an investor won?t require the services of an advisor. This would result in a lower expense ratio

The Securities and Exchange Board of India (Sebi), at its recent board meeting, nudged asset management companies to launch direct mutual fund schemes with a lower expense ratio. Schemes will now have to have a third plan, known as a direct plan, apart from the existing retail and institutional plans.

Under the direct route, an investor could invest directly with the fund house, without using the services of an advisor or distributor. Since the investor is undertaking his investment without the use of any intermediary, the markets regulator has proposed an incentive in the form of a lower expense ratio to the investor, by creating a separate share class.

Under the direct route, an investor could invest directly with the fund house, without using the services of an advisor or distributor. Since the investor is undertaking his investment without the use of any intermediary, the markets regulator has proposed an incentive in the form of a lower expense ratio to the investor, by creating a separate share class.

?To avoid differential treatment in the same scheme to different classes of investors, it was decided that all new investors will be subject to a single structure under a single plan. However, to be fair to direct investors and promote direct investment, it was decided to have a separate plan for direct investments, with a lower expense ratio,? says the Sebi note.

Currently, mutual fund investors can take the direct route to invest, but they do not have the benefit of a lower expense ratio. Analysts say the impact of this new provision of a ?separate share class? on the investing methodology of retail investors would be seen in the days to come. They say it is a definite plus for high net-worth individuals, who are more tech-savvy and are well-informed about their portfolio than retail investors.

Brijesh Damodaran, founder and managing partner of Zeus WealthWays, says for a financially literate investor, direct investment in mutual funds will be a good vehicle to increase his returns, as the cost would come down. ?Direct investment is useful to an informed investor, who knows what he?s doing, has time to monitor his portfolio, has the asset allocation in place and carries out the portfolio rebalancing as and when required on his own,? he says.

Sanjay Sinha, founder of Citrus Advisors, says it is a welcome step towards reducing the cost of mutual fund ownership for retail investors. ?We will have to wait and see how much the differential is in the expense ratio between these plans and the normal plans that have been sold so far. Only if the differential is considerable will these funds hold appeal. What fund houses save on distribution could go towards reducing the expense ratio,? he says, adding that one can expect the expense ratio of funds’ direct plans to be restricted to the amount charged as the asset management fee and scheme-related expenses, such as operating expenses.

An investor’s gain by taking the direct route can be significant if calculated over a longer period. Suppose an investor invests R1 lakh for 25 years and, over this period, the direct plan earns a return of 12% and the normal plan earns 11%.

In the direct plan, the investor?s money will compound to R17,00,006, while in the normal plan, his investment will compound to R13,58,546. This amounts to an appreciable difference of R3,41,460.

Analysts say that at a broader level, the introduction of these direct low-cost plans will lead to greater consciousness among investors about the cost of mutual funds and all other financial products in general.

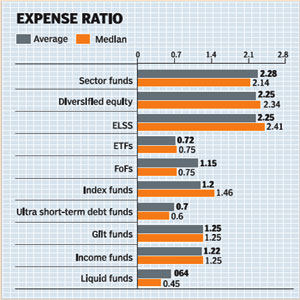

Jimmy Patel, chief executive officer of Quantum Asset Management Company, an online direct-to-investor mutual fund house, says that by approaching the fund house directly, an investor can save on the distribution cost. ?With overall investments in mutual funds getting more expensive, the pull factor seems to be hard at work for the direct route. So, fund houses should keep their cost low in a direct plan, the expense ratio should be lower to the extent of commission, which, in a normal plan, would not get paid,? he says. While the expense ratio for Quantum Long Term Equity Fund is 1.25, the industry median for diversified equity funds is 2.34.

In the US, there are load and no-load schemes. Distributors/agents sell load schemes where the load from these schemes goes towards reimbursing them, while the savvy investor who requires no hand-holding buys no-load schemes. With this measure, Sebi has pushed the Indian mutual fund market also towards a similar two-tier structure ? a structure that rewards the savvy investor. Sinha of Citrus Advisors says the introduction of direct schemes must be accompanied with a renewed push toward enhancing financial literacy in our country. ?If this is not done, these products will remain confined to a small minority of savvy investors, ? he says.

Once a regulatory change occurs, Sinha says players have to respond to it and those who are the leaders in moving towards setting up the required infrastructure for direct investing could steal a march over others.