If corporate bond issuances are fewer these days, fund managers and treasurers attribute it to a mismatch in yield expectations. “There is a large appetite for corporate bonds but borrowers are unwilling to fork out the kind of interest rates that investors are looking for,” said A Balasubramanian, CEO of Aditya Birla Sun Life AMC. Shashikanth Rathi,head of Treasury, Axis Bank, explained that when yields started hardening, issuers were somewhat reluctant to borrow at a higher rate which led to a drop in issuances.

“The general perception was the spike in yields would be temporary and that yields would cool off soon. However, it did not happen,” Rathi observed. Coupon rates on corporate bonds have seen a fairly sharp rise in recent months. Bonds rated AAA, have yields around 8.5%, for a tenor of three years now, compared with 7.70% three months back. The yield on the benchmark bond has risen by about 40 basis points (bps) over the last three months. While several banks have raised their MCLR (Marginal Cost of fund based lending rate), both Balasubramanian and Rathi believe that some borrowers may have nonetheless knocked at the doors of banks since the cost of loans is somewhat lower. Non-food credit from banks has been growing at around 12-13% year-on-year over the last few months.

In the fortnight to July 20, non-food credit decreased 40 bps y-o-y, taking the outstanding loans to `85.62 lakh crore, Reserve Bank of India (RBI) data showed. A clutch of companies, including large players such as Tata Motors, Idea Cellular, Tata Steel, Ultratech Cement and Reliance Industries have announced plans to mop up money via non-convertible debentures (NCD). In June companies had sought shareholders’ nod to raise close to `60,000 crore through NCDs in 2018-19 on a private placement basis.

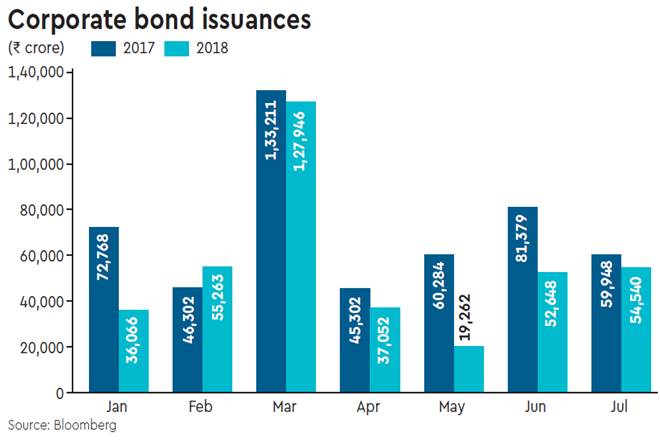

However, between January and July, issuances have totalled some `1.17 lakh crore. That’s about a fourth less than the quantum of bonds issues in the seven months to July, 2017 when it was nearly `5 lakh crore. According to data from Bloomberg, a huge chunk of these issuances include bonds from non banking finance company (NBFCs) and housing finance companies, accounting for around 75% of the total corporate bonds. Lakshmi Iyer, CIO-Debt & Head-Products, Kotak AMC, pointed out that in a rising interest rate scenario, mutual fund investors opt for securities that have a shorter maturity so that the re-pricing is better and faster.

“There is more activity happening selectively in the non- AAA segment where the quantums of deals are smaller,” Iyer said. Hitendra Dave, head of Global Banking and Markets, HSBC India, said the primary fixed income market has turned a tad illiquid. “The quantums at which one can enter and exit the market without a significant impact cost are not too large,” Dave observed.