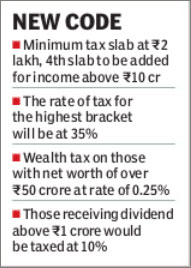

The minimum slab for income tax will remain at Rs 2 lakh per annum while a fourth slab will be added for those earning more than Rs 10 crore, the Direct Taxes Code to be approved by the Cabinet on Thursday has proposed.

The rate of tax for the highest bracket will be at 35%. This will be the first time since 1996-97 when the government settled for a three-slab income tax bracket that there will be an additional slab.

In an effort to soak the super-rich, the code, which is the largest ever revision of the Income Tax Act of 1961, also plans to levy a wealth tax on those with a net worth of over R50 crore at the rate of 0.25% of their wealth. Further, receiving dividends above Rs 1 crore too would be taxed at 10%.

Foreign companies will have to pay tax if they buy into an Indian company if as a result 20% of the global assets of the new entity is located in India. The threshold was 50% as proposed in the version of the Bill in 2010.

In a respite for India Inc, all the progressive recommendations made by the Parthasarathi Shome committee on general anti-avoidance rules and on retrospective taxation have been included in the code. This would provide a relief for Vodafone-type cases in future.

The government has accepted 153 recommendations out of the 190 made by the parliamentary standing committee on finance. The finance ministry has also accepted the changes made in the Finance Acts of 2011, 2012 and 2013 in the new code, likely to be tabled by the end of the current session of Parliament.

The code has retained the 30% tax on corporates, as proposed in DTC 2010, and agreed to by the standing committee. It has also proposed what it calls ring-fencing of losses from businesses availing investment-linked incentive.

On personal income tax, while the committee had asked for the minimum tax rate to kick in from Rs 3 lakh, the finance ministry pointed out: ?The recommendation will result in huge losses. The total revenue loss on account of recommended changes in personal income tax slab and removal of cess works out to be R60,000 crore approximately.?

?To maintain overall progressivity in levy of income tax, it is proposed to provide for a fourth slab for individuals, Hindu undivided family and artificial judicial persons with total income exceeding Rs 10 crore to be taxed at 35%,? the finance ministry said in a Cabinet note.

The standing committee had considered the draft presented by then finance minister Pranab Mukherjee in 2010, which was completely different from the one presented in 2009 by finance minister P Chidambaram. While the first version promised to usher in an overhaul of the Income Tax Act, the revised version by Mukherjee toned them down, which now continue in their current version in the I-T Act.