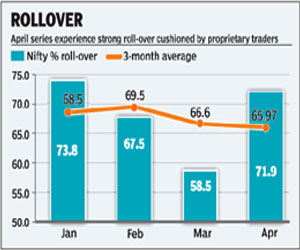

Despite lower participation by foreign institutional investors (FIIs), the Nifty April series witnessed its highest rollover since January. At 71.9%, the rollover of the Nifty futures also stood significantly higher than its three-month average of 66%.

Traders attribute this strong rollover to a heightened participation by the proprietary desks in wake of a relatively lower involvement of the FIIs since the start of April series.

?Evidently, proprietary traders were more active in rolling over their positions as well as creating fresh positions in the May series, which resulted in such a strong rollover number. FIIs, on the other hand, have continued to exit both their short and long positions since late March,? said a derivatives trader.

Another trader, however, pointed out that the strong rollover has happened with a lower base of total open interest in the Nifty futures, which during the course of April series, hit a multi-year low of 1.93 crore shares on April 10. According to estimates, the FII participation in the derivatives segment has recently dropped to 30% from an average range of 37-40% in the past.

Another trader, however, pointed out that the strong rollover has happened with a lower base of total open interest in the Nifty futures, which during the course of April series, hit a multi-year low of 1.93 crore shares on April 10. According to estimates, the FII participation in the derivatives segment has recently dropped to 30% from an average range of 37-40% in the past.

?The strong rollovers have nonetheless happened on a lower base and may not give a clear indication of whether they are on a net basis on the short (sell) or the long (buy) side. An increase in the Nifty open interest from hereon can determine whether the Nifty will eventually fall below 5,200-5,150 mark,? said the trader.

According to market observers, even market-wide and stock-specific rollover remained above average, higher than 80%. Among heavyweights, TCS and Infosys witnessed long-positions being rolled over while strong short positions were rolled over in DLF as well as Wipro. On a sectoral basis, strong short rollovers were observed in the banking, metals and capital goods stocks.

Traders, however, are now eyeing the range of 5,200-5,130 as the key support zone for the Nifty.

A day prior to the expiry both 5,200 calls and 5,200 puts of May series gained the highest open interest on the respective side, showing the importance of the level as also indecisiveness among traders as to whether this support will sustain. In Thursday’s trade, however, May 5,100 puts added the maximum open interest of

9 lakh shares for the day, while May 5,000 puts maintained the highest open interest of 39.2 lakh shares on the put side.