We see some early signs of abatement in impaired loan accretion for the larger PSU banks. Our analysis of five key loan-intensive sectors shows that the average size of stressed corporates doubled in the past two years, with persistently high interest rates a bigger determinant of stress than their operating performance. With uncertainties around interest rates ebbing and GDP growth picking up from here, we expect lower net impairment into FY15F (forecast). While we retain our preference for private sector banks given their structural advantages, we think the valuation comfort offered by some large PSUs offers interesting near-term opportunities.

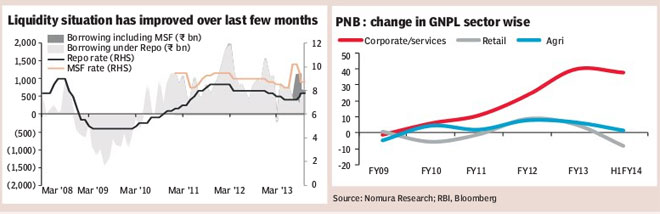

We highlight how improving macro, better trends in agri and retail and the recent discom restructuring offers comfort on incremental delinquencies.As well, we analyse the interest coverage trends across five other key sectors?textile, metals, E&C (engineering & construction), chemicals and food processing?which make up for 30% of incremental impairment over last two years.

Despite operating margin uptrend, high interest costs drive higher delinquencies: Our analysis of companies with ICR (interest coverage ratio) less than 1x points to high interest rates being a key factor behind higher delinquencies despite export-driven sectors (textiles, metals, chemicals) showing improvement in their operating margins. The food processing sector (e.g., sugar) has been hit by pricing disputes impacting supply; but we expect some resolution given its political sensitivity. Continued stress for E&C is likely until the capex (capital expenditure) cycle revives but some large restructuring done recently would ease delinquencies.

The increasing size of stressed corporates could drive larger and lumpy recoveries: Average annual turnover of stressed companies rose to R4 bn from R2 bn three years ago driving up the ratio of stressed loans in the system. This implies potentially large and lumpy recoveries for the PSUs with any turn in macro.

While PNB and a few mid-size PSU banks offer valuation comfort, tight co-movement between impairment accretion and valuation for PSUs indicates strong potential for re-rating on any trend improvement.

Implication for coverage stocks: While we continue to like private sector banks over a longer horizon given their structural strengths, we believe asset quality trajectory would offer tactical opportunities into PSUs.

How does the valuation stack up for large PSU banks? We have seen tight co-movement between valuation of PSU banks and their incremental impairment. Within our coverage, SBI and BOB are yet to report a meaningful turn in their asset impairment trends, and are relatively richly priced. On the other hand, for PNB the turn in NPL (non-performing loan) cycle is more visible while valuation comfort is much bigger. We upgrade PNB to Buy with a target price of R625. We also upgrade both SBI and BOB to Neutral from Reduce, but we would wait for more asset quality data points on their mid-corporate loan book before turning more positive.

Key risks to our thesis:

*Low provision coverage for PSU banks implies stickiness in loan loss provisions even if impairments start declining rapidly.

*Low core equity ratios make PSUs dependent perennially on government for capital infusion.

*Increasing trends on opex ratios?with any increase in pension and wage revision provisioning, in the absence of higher growth, the opex ratios are likely to trend higher for PSUs.

*Ceding market share in CASA deposits and retail assets?with private sector banks gaining incremental share of CASA (current account, savings account) and retail assets like mortgage; PSU banks would continuously feel some pressure on their NIMs. Some of the larger PSUs continue to enjoy a stickier retail franchisebut in the longer term they are likely to see some return erosion on account of these factors.

We upgrade PNB with a revised target price. While we think immediate relief in impairment trends is not yet visible for PSU banks, we see improvement in underlying operating margins for loan-intensive corporate, particularly in the export-driven sectors. We expect this, along with potentially a benign macro environment, to drive strong recoveries going into FY15F.We revise our H2FY14F earnings by 3% on marginally lower LLPs (loan loss provisioning) while building in capital infusion announced by GoI.

While delinquency trends have improved for Punjab National Bank , recovery has been much stronger. PNB has shown improvement in GNPL (gross NPL) accretion across retail, agri and industry sectors. As well, with the highest exposure to discoms among large PSUs, PNB has benefited more from the recent FRP implementation. In addition, PNB offers the most valuation comfort among the three PSUs in our coverage. While low provision coverage, high MTM (mark-to-market) outgo and pressure on NIMs would be dampeners, we expect this stock to be the best positioned for a re-rating once the asset quality trends start improving.

Valuation: Our target price implies 0.63x 1-year forward ABV of (adjusted book value) R994 and 0.93x on NNPL (net NPL) adjusted 1-year forward book of R670 for an adjusted RoE of 12.1% for FY14F. At current prices, PNB is trading at 0.56x 1-year forward ABV.