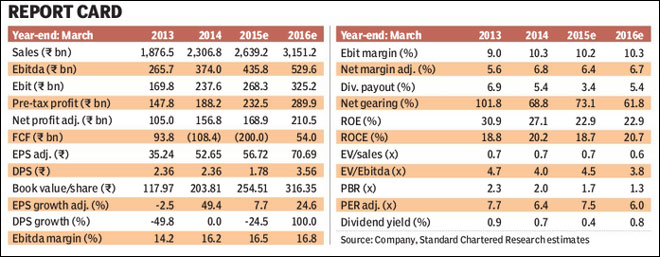

Tata Motors’ (TTMT) consolidated Q4FY14 earnings came in below our estimates due to margin pressure at both JLR and the standalone business. JLR?s margin declined 190bps quarter-on-quarter on adverse mix and currency impact. We expect JLR?s healthy product pipeline to help drive a steady 14% volume CAGR in FY14-16. Capacity constraints should be resolved with the launch of new capacity in H2. Despite increased capex, JLR generated FCF (free cash flow) of GBP 1.1bn in FY14. Maintain Outperform with revised PT (price target) of Rs 475.

Under its new accounting policy, JLR?s margin declined 190 basis points q-o-q to 17.2%, due to a relatively lower contribution from RR/RR Sport and lower sales to China q-o-q. An adverse USD-GBP rate also hurt margins. Adjusted for one-offs, profit after tax came in at GBP 515mn, below our estimate of GBP 558mn.

Standalone entity still under stress: As a result of poor sales, elevated discounts and continued marketing expenditures, TTMT reported an Ebitda loss of R5.3bn, while we estimated positive Ebitda (earnings before interest, taxes, depreciation and amortisation) of R1.5bn. Adjusted for one-offs, TTMT reported a loss of R7.8bn versus our estimate of an R7.1bn loss in Q4.

Consolidated earnings up 20% y-o-y: At the consolidated level, operating margins remained stable q-o-q at 16.5%.

Adjusted for one-offs, consolidated PAT rose 20% year-on-year to

R 47bn? lower than our estimate of R51bn.

Valuation: Capacity expansion at Solihull by December 2014 and the China JV’s launch should ease of capacity constraints at JLR. JLR?s healthy product pipeline and strong demand for RR and RR Sport should drive steady volume growth: we factor in a 14% volume CAGR in FY14-16. We think the margin impact from a deteriorating product mix (due to future JLR launches) should be more than offset by cost savings from the platform consolidation strategy, in-house engine sourcing and commercialisation of the JLR-Chery JV. We maintain our Outperform rating, and raise our price target to R475 (R435 earlier) as we roll over to FY16 earnings, which offers 12% upside from current levels.

Outlook on standalone entity

With stable national government and expectations of a strong push for infrastructure projects, we expect CV (commercial vehicle) sales to pick up from H2FY15. In the PV (passenger vehicle) business, TTMT has already launched several models, including the Nano Twist, Vista VX Tech and the all-new Tata Aria. It is slated to launch the Zest and the Bolt in H2. Led by these new launches and an improved economy, we expect TTMT?s PV/CV sales to pick up from H2.

JLR performance

JLR changed its accounting methodology for reporting Ebitda starting Q4FY14. Ebitda is now defined as including revaluation of current assets and liabilities and realised FX (foreign exchange) and commodity hedges. It excludes revaluation of long-term foreign currency debt and unrealised FX and commodity hedges. In other words, the realised portion of the hedge book in the quarter is now recognised as part of Ebitda, and the balance is recognised below the line.

JLR?s performance was disappointing, as it reported a 190bps margin decline q-o-q to 17.2% (under the new accounting policy). The margin decline was primarily due to adverse sales mix and adverse currency movements in Q4. China?s contribution to total sales declined 80bps q-o-q to 24%, while RR and RR Sport?s contribution fell to 29%, down from 31% in the previous quarter. The average USD-GBP exchange rate was 1.66, versus 1.62 in Q3.

– Standard Chartered