Titan Industries Ltd hopeful of RBI?s approval for international hedging of gold price: We hosted Titan management for investor meetings in Singapore recently. Most questions were obviously on regulatory scenario and how Titan is engaging with RBI. Titan management has appealed to RBI to be allowed to hedge the gold price risk internationally as local MCX liquidity is not high enough to cover Titan?s scale and contracts lengths are ineffective. Titan management is hopeful that RBI may look at their proposal favourably. We think this potential event will be significantly positive as the financial cost of upfront payment for gold is not material, but it is the gold price risk that exposes Titan?s inventory to material risk in the absence of effective hedging, a situation

Titan management describes as much more precarious than the pure financial cost.

Gold supply situation now improves: (i) Gold imports, which were almost halted since 22 July post-20:80 export regulation, have resumed, ahead of festive demand and Titan is hopeful of securing its own supply. (ii) Titan has also started to explore ways to export on its own either directly, selling to an exporter or through wholesale route, which will also enable it to use its direct import licence. In any case, Titan is not looking to make large capital investment to achieve this. (iii) While compliance with the export ruling doesn?t apply to Titan but impacts the importing bank or the nominating agency, it still favours jewellery exporters, who become the essential entity by virtue of their presence and operation in the value chain; gold can be imported for domestic consumption and hence will demand a compensation. (iv) Another issue is that gold smuggling has increased as a result of duty increases and import restrictions and is causing a distortion in the market pricing of gold and level playing field with unorganised market of jewellery. While Titan admits this distortion is an issue, it also believes that the trust Titan enjoys still creates its pull.

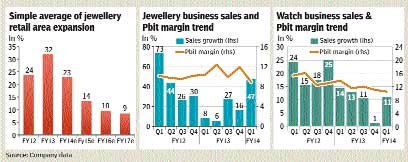

Jewellery expansion plans are on track: Titan nonetheless is upbeat about the prospects of the organised jewellery industry and has no plans to change its expansion plans this year (remains 100k sq ft for FY14) unless there is severe gold supply issue. Titan also confirms that large format store expansion is now complete and it is looking to add marginal area in L2 (where inventory is owned by Titan, but retail operations are run by franchise) and L3 (where inventory ownership and retail operation are with franchisee).

Challenges but competitive advantages: Titan believes that its scale and reputation gives it a significant competitive advantage over smaller organised jewellers in funding working capital or even securing supply of gold. In effect, the leasing ban has actually made Titan stronger than competitors.

Near-term demand: Q2 gold demand is likely to be weak as it is a seasonally weaker quarter and also due to advanced purchases by consumers in the last quarter (when jewellery sales were up 47% y-o-y). Titan also decided not to sell gold coins (which usually is under 10% of sales) but its diamond promotion in this quarter has done well, and revenue mix will be substantially better than the last quarter which should make up for weaker gold jewellery sales. In particular, its Inara (affordable diamond jewellery range, priced below R500k, but designed to give the appearance of large ticket diamond jewellery) got a good response in market.

But watches are going through a rough patch: Watch margins and demand are clearly under pressure. Last quarter same-store growth declined 1% y-o-y and Q2 is unlikely to be better. INR weakness has weighed on margins (50% of components are imported) and Titan had to take another price hike to keep the margins from falling. Strategically too, Titan is working towards making the Titan brand positioning as more premium, which should help address the balance of margins and volumes. Titan has also invested in a stainless steel case factory with the technical assistance of Seiko, the Japanese watch maker, which will reduce its reliance on imports.

Fragrance new launch: Titan has launched six variants of ?Skin? brand perfumes (three for men and women each) each in 50ml and 100ml units (R990 and R1,790 each) and plans to go to top 10 cities to start with. This foray is consistent with its strategy of becoming a lifestyle company and aims to use its own distribution and other channels such as departmental stores.

Titan sees fragrances as a large and growing opportunity (R25 bn and growing is strong double digits) and with significant gaps. As per Titan management, its fragrance is a world-class product, manufactured in France and by the same perfumers who also develop perfumes for several global luxury brands. Titan has priced it nearly half that of typical luxury perfumes and plans to position it as mass luxury fragrance product. Launch will be accompanied by a strong campaign.

It aims to spend R500m in brand building initiatives and revenue of R2.5 bn in the next 3-5 year window.

Other businesses: Eyewear is growing quite well and is on track to become profitable in the next couple of years. Fastrack is progressing well, while urban demand is weak but rural and semi-urban demand remain quite robust. Other than Tanishq, Titan is not looking to add any substantial retail area in any of the formats this year.

?HSBC