The recent transaction: Siemens AG sold 1.2% of its stake in Siemens India (3.96m shares) this month. The genesis of this deal was the increase in its stake in the Indian arm to 76.2% (i.e., 1.2% more than the maximum permissible limit for a listed company) because of the merger of several unlisted entities in the listed arm. Even after buying back shares last year (January 2011) from public shareholders at a higher price of R930, the company reduced its stake to the permissible limit of 75% at a lower average price of R667, suggesting that Siemens AG intends to keep Siemens India listed. Hence, in our opinion, the delisting premium built into the stock should unwind.

Siemens re-rated 15% post-open offers from ABB and Areva T&D in May 2010: We further note that after the open offers from ABB and Areva T&D (now Alstom T&D) in May 2010, which came in at a premium of 31% and 10% to the then prevailing prices, Siemens? multiples (12m forward PE) re-rated upwards by 15% on average compared to historic valuations until then. This re-rating, in our opinion, can be considered as a potential de-listing premium.

Siemens re-rated 15% post-open offers from ABB and Areva T&D in May 2010: We further note that after the open offers from ABB and Areva T&D (now Alstom T&D) in May 2010, which came in at a premium of 31% and 10% to the then prevailing prices, Siemens? multiples (12m forward PE) re-rated upwards by 15% on average compared to historic valuations until then. This re-rating, in our opinion, can be considered as a potential de-listing premium.

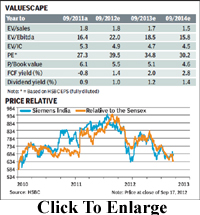

Maintain Underweight and remain significantly below consensus: We continue to believe that the quality of Siemens India?s earnings has eroded considerably with a significant decline in order book and heightened volatility in margins. We find consensus estimates overly optimistic, particularly on margins, and remain 23/26% below consensus on FY12/13e EPS (earnings per share). Even on a through cycle basis, we believe Siemens? return profile has structurally deteriorated driven by permanent erosion in power transmission margins and a decline in asset turns due to an increase in investments. Hence, in our view, not only should the delisting premium unwind but the stock should also de-rate vs. the last cycle?s average 12m forward PE (price-to-earnings) of 24x. The stock remains expensive at 34.8x FY13e PE; reiterate UW with a TP of R590.

Valuation and risks

Our target price of R590 is derived from our preferred EVA (economic value added) valuation methodology, assuming target sales growth of 8%, a target operating return of 8%, and a WACC (weighted average cost of capital) of 11.3%. Our TP implies a 12-month forward target PE of 26.2x (times) on FY14e EPS of R22.5. Even with our optimistic view on margin recovery going into FY13/14, we believe that, unless large orders materialise, consensus expectations of a margin improvement in FY13/14 will prove lofty. We remain 23-26% below consensus on FY12/13e EPS and reiterate our UW rating on the stock. On our estimates, the stock remains expensive. We highlight the key upside risks related to our investment case for Siemens India: (i) Significant or large order wins, (ii) Better-than-expected improvement in margins of provisions and (iii) Continued strength in short-cycle orders.

HSBC Research