Punjab National Bank (PNB) Q1FY15 earnings came in at Rs 14.1 bn (+10% y-o-y), 35% above our estimate predominantly driven by write back of investment depreciation.

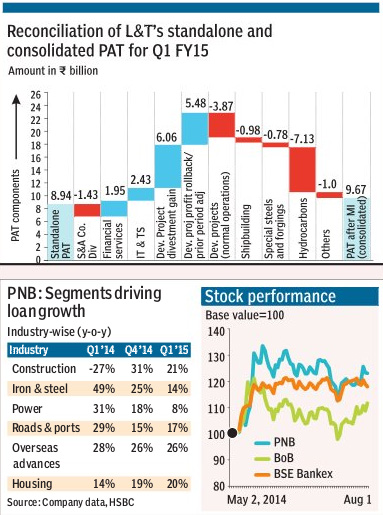

Q1FY15 operational review: NII (net interest income) was up 12% y-o-y driven by 14% y-o-y loan growth which was in turn driven by retail and SME. CASA (current account savings account) ratio remained under pressure, down q-o-q to 36.8% despite which margins were up 22bps q-o-q to 3.42% predominantly driven by the impact of lower slippages. Gross NPL ratio increased 23bps q-o-q to 5.48% but slippages decelerated to 3.3%. Hence, credit costs declined 54 bps q-o-q to 153 bps, which remains elevated. Provisions for UFCE (unhedged foreign currency exposure) were R0.5 bn made on an ad hoc basis as the bank seeks more clarity from customers. Restructured advances declined q-o-q to 9.5% and the management does not see any pipeline currently. Tier-1 capital was stable at 8.8%, and RoA (return on assets) for the quarter was 1%, which is the management?s medium term target.

Outlook? advantage PNB: While some of the PSUs? growth has been erratic, PNB has consistently slowed from around Q1FY12 with growth picking up only recently. Also, its slippages tend to reflect cyclical related stresses, which is not very evident for other PSU banks. Our earnings estimates continue to remain conservative on growth, margins and asset quality despite which we believe PNB is better positioned vs most PSU peers to take advantage of a turnaround in the credit cycle.

Valuation: PNB is trading at 1.1x 12-month rolled forward ABV?adjusted book value?(July 2016). We value PNB at 1.1x P/AB (price-to-adj.book value), resulting in our revised TP (target price) of R1,088 (R1,066) implying potential return of 19.4%.

?HSBC